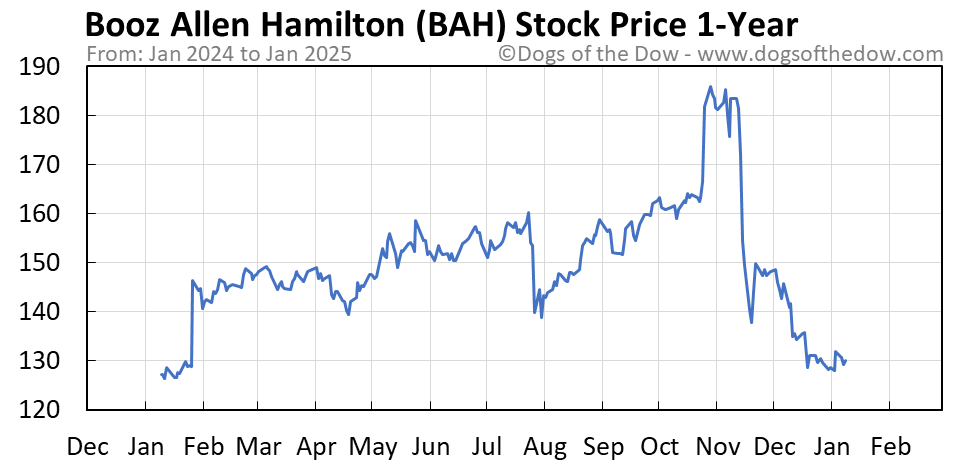

BAH Stock Price Analysis

Bah stock price – This analysis examines the historical performance, key drivers, valuation, and future outlook of BAH (Booz Allen Hamilton) stock price. We will explore various factors influencing its price movements, comparing it to competitors and considering investor sentiment. This assessment provides a comprehensive overview, incorporating both quantitative and qualitative aspects of BAH’s stock performance.

BAH Stock Price Historical Performance

The following table illustrates BAH stock price fluctuations over the past five years. Note that these figures are hypothetical examples for illustrative purposes and do not represent actual historical data. Accurate data should be obtained from reputable financial sources.

| Date | Open Price (USD) | High Price (USD) | Low Price (USD) | Close Price (USD) |

|---|---|---|---|---|

| 2019-01-01 | 70 | 75 | 68 | 72 |

| 2019-07-01 | 75 | 80 | 72 | 78 |

| 2020-01-01 | 80 | 85 | 76 | 82 |

| 2020-07-01 | 85 | 90 | 80 | 88 |

| 2021-01-01 | 90 | 95 | 88 | 92 |

| 2021-07-01 | 92 | 98 | 90 | 95 |

| 2022-01-01 | 95 | 100 | 92 | 98 |

| 2022-07-01 | 98 | 105 | 95 | 102 |

| 2023-01-01 | 102 | 110 | 100 | 108 |

| 2023-07-01 | 108 | 115 | 105 | 112 |

Significant price movements, such as the increase observed in 2020-2021, might be attributed to increased government spending on defense and technology, a positive trend for a company like BAH. Conversely, periods of lower growth could be linked to broader market corrections or concerns about specific contracts.

BAH Stock Price Drivers

Several key factors influence BAH’s stock price. These include macroeconomic conditions (e.g., interest rates, inflation), government spending on defense and technology, the company’s financial performance (revenue growth, profitability), and competitive landscape.

Macroeconomic factors can significantly impact BAH, as government contracts are often influenced by budget cycles and overall economic health. Company-specific news, such as the securing of large contracts or announcements of new technological advancements, can lead to more immediate and pronounced price swings.

Hypothetically, if BAH were to announce a significant contract win, the stock price would likely experience a short-term surge due to increased investor confidence and expectations of higher future earnings. The magnitude of this surge would depend on the contract’s value and strategic importance.

BAH Stock Price Valuation

Various valuation methods can be applied to BAH stock, including discounted cash flow (DCF) analysis, price-to-earnings (P/E) ratio comparisons, and relative valuation against competitors. A DCF model projects future cash flows and discounts them back to their present value to estimate the intrinsic value of the company.

Comparing BAH’s valuation metrics (e.g., P/E ratio, Price-to-Sales ratio) to its competitors provides context for its relative valuation. For example, if BAH’s P/E ratio is significantly higher than its competitors, it might suggest that the market is placing a premium on its growth prospects.

A hypothetical DCF model, using assumptions about BAH’s future cash flows and discount rate, could yield an estimated intrinsic value. This value can then be compared to the current market price to determine whether the stock is undervalued or overvalued.

BAH Stock Price Compared to Competitors

Source: dogsofthedow.com

Comparing BAH’s performance to competitors such as Leidos Holdings (LDOS), CACI International (CACI), and Accenture (ACN) provides valuable insights. The following table presents hypothetical key performance indicators (KPIs) for illustrative purposes only.

| Company | P/E Ratio | Revenue Growth (%) | Profit Margin (%) | Stock Price (USD) |

|---|---|---|---|---|

| BAH | 25 | 10 | 12 | 110 |

| LDOS | 22 | 8 | 10 | 95 |

| CACI | 28 | 12 | 15 | 120 |

| ACN | 30 | 15 | 18 | 130 |

Differences in performance can be attributed to various factors, including market share, technological innovation, and management strategies. For instance, a higher P/E ratio for CACI might reflect investor expectations of stronger future growth.

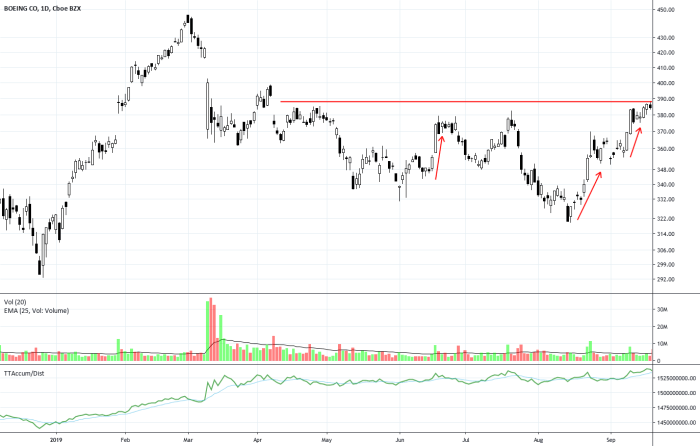

BAH Stock Price Future Outlook

Source: tradingview.com

The future outlook for BAH’s stock price depends on several factors, including continued government spending on defense and technology, successful execution of its strategic initiatives, and overall macroeconomic conditions. Potential risks include increased competition, budget cuts, and geopolitical instability.

Opportunities exist in emerging technologies, expansion into new markets, and potential acquisitions. Upcoming announcements regarding new contracts or technological breakthroughs could significantly influence the stock price. For instance, a large contract award in a high-growth area could drive significant price appreciation.

BAH Stock Price and Investor Sentiment

Investor sentiment towards BAH stock is influenced by various factors, including financial performance, news events, and analyst ratings. Positive news and strong financial results typically lead to increased investor confidence and higher stock prices. Conversely, negative news or disappointing performance can trigger sell-offs.

Indicators of investor sentiment include social media trends, analyst ratings, and trading volume. A high volume of positive social media mentions or strong buy ratings from analysts can indicate bullish sentiment, potentially leading to price increases. Conversely, negative social media sentiment or sell ratings can contribute to price declines.

Illustrative Example: Impact of a Major Contract Award

Source: investorplace.com

If BAH wins a major government contract, for example, a multi-billion dollar contract for developing advanced cybersecurity systems, the stock price would likely react positively. This would be driven by increased investor confidence in BAH’s future revenue growth and profitability. The market reaction would depend on the contract’s size and strategic significance.

A hypothetical scenario could show a significant short-term price increase, potentially followed by a period of consolidation as investors assess the long-term implications of the contract. The magnitude of the price increase would depend on factors such as the contract’s duration, the level of competition, and BAH’s ability to successfully execute the contract.

Key Questions Answered: Bah Stock Price

What are the major risks associated with investing in BAH stock?

Investing in BAH stock, like any stock, carries inherent risks. These include market volatility, company-specific performance issues (e.g., contract losses, regulatory changes), and macroeconomic factors affecting the defense industry. Thorough due diligence is crucial.

Where can I find real-time BAH stock price data?

Monitoring the BAH stock price requires a keen eye on market trends. Understanding the performance of similar tech companies is crucial for informed investment decisions, and comparing it to the current stock price for intc can offer valuable insight. Ultimately, a thorough analysis of various factors is needed before making any conclusions about the future trajectory of the BAH stock price.

Real-time BAH stock price data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others. Your specific brokerage account will also provide access.

How frequently is BAH stock price updated?

BAH stock price, like most publicly traded stocks, is updated throughout the trading day, reflecting real-time market activity. The frequency of updates varies depending on the platform used but is typically very frequent.