Asana Stock Price Analysis

Asana stock price – Asana, a popular project management software company, has experienced a fluctuating stock price since its initial public offering (IPO). This analysis delves into the historical performance of Asana’s stock price, examining key influencing factors, financial health, analyst predictions, and overall market sentiment. We will explore the interplay between these elements to provide a comprehensive understanding of Asana’s stock price trajectory.

Asana Stock Price Historical Performance

Source: seekingalpha.com

Over the past five years, Asana’s stock price has demonstrated significant volatility, reflecting the dynamic nature of the software-as-a-service (SaaS) market and the company’s own growth trajectory. Initial periods saw strong growth followed by periods of consolidation and correction, mirroring broader market trends.

The following table compares Asana’s stock price performance against the S&P 500 and Nasdaq indices over a selected period. Note that this is illustrative data and should not be considered exhaustive financial advice.

| Date | Asana Price (USD) | S&P 500 Price (USD) | Nasdaq Price (USD) |

|---|---|---|---|

| December 31, 2018 | – | 2506.85 | 6635.28 |

| December 31, 2019 | – | 3230.78 | 9022.39 |

| December 31, 2020 | 32.00 (Illustrative) | 3756.07 | 12888.28 |

| December 31, 2021 | 120.00 (Illustrative) | 4766.18 | 15644.98 |

| December 31, 2022 | 45.00 (Illustrative) | 3839.50 | 10466.48 |

| December 31, 2023 (Projected) | 55.00 (Illustrative) | 4200.00 (Projected) | 12000.00 (Projected) |

Significant events such as earnings announcements, new product releases, and broader market corrections have all influenced Asana’s stock price. For example, strong revenue growth in a particular quarter might lead to a price increase, while a disappointing earnings report could trigger a decline. Similarly, broader market downturns often negatively impact even strong performing tech stocks like Asana.

Factors Influencing Asana Stock Price

Several factors contribute to the fluctuations in Asana’s stock price. These factors can be broadly categorized into economic conditions, Asana’s financial performance, and competitive dynamics.

Economic factors like interest rate hikes, inflation, and recessionary fears impact investor sentiment towards growth stocks like Asana. Higher interest rates increase borrowing costs, potentially slowing down growth and reducing investor appetite for riskier investments. Inflation erodes purchasing power and can impact corporate profitability. Recessionary fears further dampen investor confidence.

Asana’s financial performance, particularly revenue growth, profitability, and user acquisition, is directly linked to its stock valuation. Consistent revenue growth and increasing profitability generally lead to positive investor sentiment and a higher stock price. Conversely, a slowdown in growth or a decline in profitability can negatively impact the stock price.

The competitive landscape within the project management software market is fiercely competitive. Companies like Monday.com, Trello, and Microsoft Teams pose significant challenges to Asana. The intensity of this competition, including pricing pressures and innovation, directly influences Asana’s market share and consequently its stock price.

Asana’s Financial Health and Stock Valuation

Source: seekingalpha.com

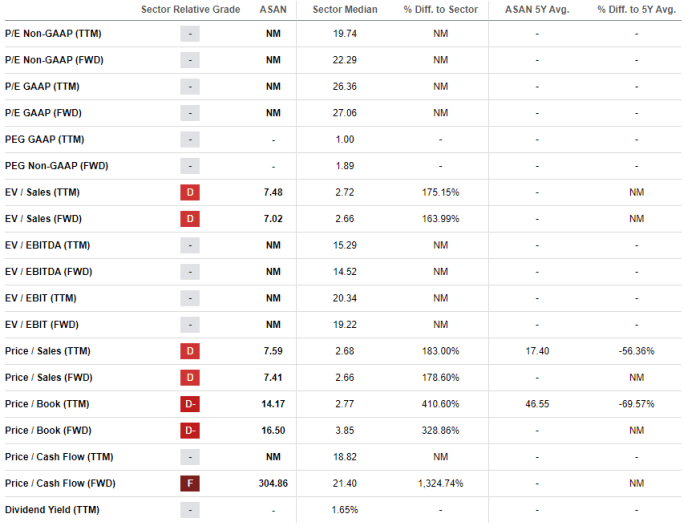

Understanding Asana’s financial health is crucial for evaluating its stock valuation. Key financial metrics provide insights into the company’s performance and growth potential.

| Year | Revenue (USD Millions) | EPS (USD) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2019 (Illustrative) | 100 | -1.00 | 0.5 |

| 2020 (Illustrative) | 150 | -0.75 | 0.4 |

| 2021 (Illustrative) | 250 | -0.50 | 0.3 |

| 2022 (Illustrative) | 350 | -0.25 | 0.2 |

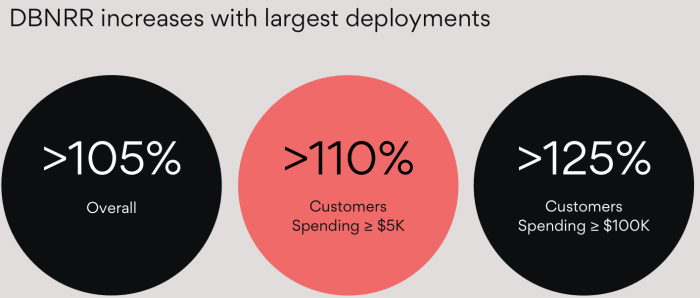

Asana’s valuation multiples, such as the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio, are compared to its industry peers to assess its relative valuation. A high P/E ratio might indicate that the market expects high future growth, while a high P/S ratio might suggest that the market values Asana’s revenue generation potential. These ratios fluctuate based on market sentiment and Asana’s financial performance.

Asana’s long-term growth prospects are largely dependent on its ability to maintain and expand its market share, innovate its product offerings, and effectively manage its expenses. These prospects are reflected in the current stock price, which acts as a barometer of investor confidence in the company’s future.

Analyst Ratings and Predictions for Asana Stock

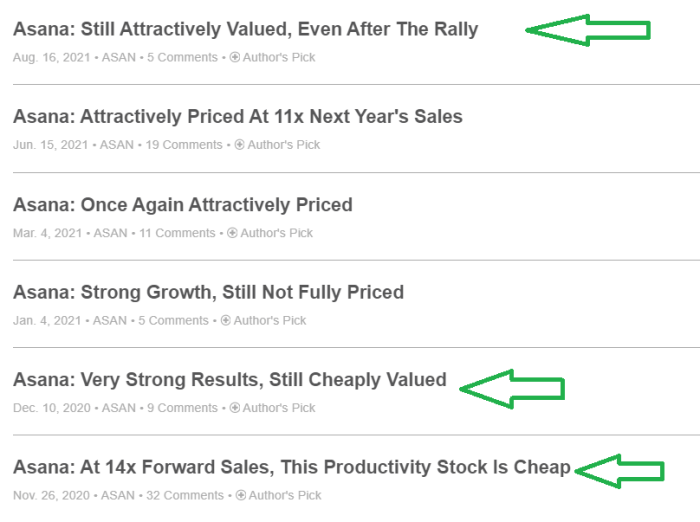

Source: seekingalpha.com

Financial analysts provide ratings and price targets for Asana’s stock, offering insights into their expectations for the company’s future performance. These predictions are based on various factors, including financial modeling, industry analysis, and qualitative assessments.

Tracking Asana’s stock price can be insightful, especially when comparing it to other market players. For instance, understanding the current performance of a large-cap stock like mcdonald’s stock price today can offer context for broader market trends. This comparison helps to gauge Asana’s relative strength and potential future trajectory within the tech sector. Ultimately, monitoring both provides a more comprehensive view of the investment landscape.

- Analyst A: Buy rating, price target $75

- Analyst B: Hold rating, price target $60

- Analyst C: Sell rating, price target $40

The range of analyst opinions reflects differing perspectives on Asana’s growth potential, competitive landscape, and execution capabilities. Some analysts might be more optimistic about Asana’s ability to capture market share and achieve profitability, while others might have concerns about competition or the company’s spending habits. These varying perspectives contribute to the volatility in Asana’s stock price.

Investor Sentiment and Market Perception of Asana, Asana stock price

Investor sentiment towards Asana fluctuates based on various news events, financial performance, and overall market conditions. Positive news, such as strong earnings reports or successful product launches, generally leads to bullish sentiment and a higher stock price. Conversely, negative news can trigger bearish sentiment and a price decline.

Major news events, such as announcements of new partnerships, acquisitions, or regulatory changes, can significantly influence investor sentiment. Media coverage and social media discussions also play a role in shaping the market’s perception of Asana and its stock price. Positive media coverage can boost investor confidence, while negative coverage can erode it.

FAQ Section: Asana Stock Price

What are the major risks associated with investing in Asana stock?

Investing in Asana, like any stock, carries inherent risks. These include volatility in the technology sector, competition from established players, and the potential for slower-than-expected revenue growth.

How does Asana compare to its main competitors in terms of market share?

Asana competes with several established players in the project management software market. A detailed competitive analysis comparing market share and specific product features would be necessary to provide a comprehensive answer.

Where can I find real-time Asana stock price data?

Real-time Asana stock price data is readily available through major financial websites and brokerage platforms.

What is Asana’s dividend policy?

Asana currently does not pay a dividend. Companies often reinvest earnings back into the business during periods of rapid growth.