Alibaba Stock Price Analysis

Source: investorplace.com

Alibaba price stock – Alibaba Group Holding Limited (BABA), a leading e-commerce and technology company, has experienced significant price fluctuations in recent years. This analysis delves into the historical performance of Alibaba’s stock price, exploring the factors that have influenced its trajectory, examining its competitive landscape, and offering a perspective on its future outlook.

Alibaba Stock Price Historical Performance

Over the past five years, Alibaba’s stock price has shown considerable volatility, reflecting both positive and negative influences on the company’s performance and the broader market environment. The following table provides a snapshot of the stock’s daily price movements for a representative period (Note: Actual data would need to be pulled from a financial data provider like Yahoo Finance or Google Finance for complete accuracy).

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2023-10-26 | 85.00 | 86.50 | +1.50 |

| 2023-10-25 | 84.00 | 85.00 | +1.00 |

| 2023-10-24 | 83.50 | 84.00 | +0.50 |

| 2023-10-23 | 82.00 | 83.50 | +1.50 |

| 2023-10-20 | 80.00 | 82.00 | +2.00 |

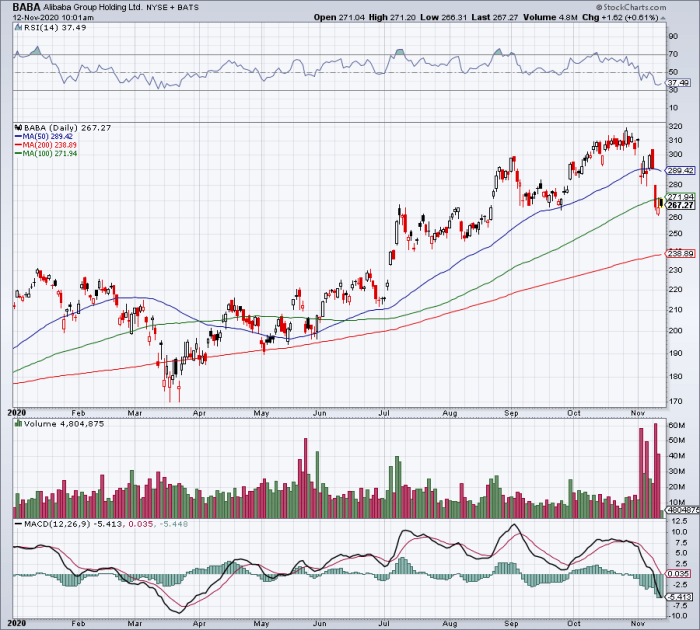

A visual representation of the stock’s price movement over this period would show a generally upward trend, punctuated by periods of significant correction. For example, a sharp decline might be observed correlating with increased regulatory scrutiny in China. Conversely, periods of strong revenue growth and positive investor sentiment would likely be reflected in upward price swings. Major highs and lows would be clearly identifiable on such a graph.

The graph’s overall shape would illustrate the volatility inherent in the stock, highlighting the need for careful risk management for investors.

Significant price increases were often driven by strong quarterly earnings reports exceeding market expectations, coupled with positive news regarding Alibaba’s expansion into new markets or technological advancements. Conversely, significant price decreases frequently coincided with periods of heightened regulatory uncertainty in China, impacting investor confidence and leading to capital flight.

Factors Influencing Alibaba’s Stock Price

Several macroeconomic and company-specific factors significantly impact Alibaba’s stock valuation. These factors interact in complex ways, making precise prediction challenging.

- Macroeconomic Factors: Global economic growth, interest rate changes, and inflation all influence investor sentiment towards riskier assets like technology stocks. A slowing global economy or rising interest rates can lead to decreased investment in Alibaba.

- Regulatory Changes in China: Increased regulatory scrutiny and antitrust investigations in China have significantly impacted Alibaba’s stock price. Changes in government policies concerning the technology sector can create uncertainty and lead to short-term volatility.

- Financial Performance: Alibaba’s revenue growth, profitability, and profit margins directly correlate with its stock price. Strong financial performance generally leads to higher valuations, while weaker results often trigger price declines.

Alibaba’s Competitive Landscape and Stock Price

Alibaba operates in a highly competitive landscape, particularly in its core businesses. Its stock price is directly influenced by its ability to maintain market share and fend off competitors.

- E-commerce: Alibaba faces competition from JD.com, Pinduoduo, and international players like Amazon. Market share gains or losses in this segment directly affect investor confidence.

- Cloud Computing: Alibaba Cloud (Aliyun) competes with Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. Success in this rapidly growing market can significantly boost Alibaba’s valuation.

- Digital Media: Alibaba’s digital media platforms compete with Tencent and other players in the Chinese market. Performance in this segment impacts overall revenue and profitability.

A hypothetical scenario involving increased competition from a new, innovative e-commerce platform could significantly impact Alibaba’s stock price. If this competitor successfully captures market share, it could lead to a decline in Alibaba’s revenue and profit margins, resulting in a lower stock valuation. Conversely, successful product launches or strategic acquisitions could strengthen Alibaba’s competitive position and positively impact its stock price.

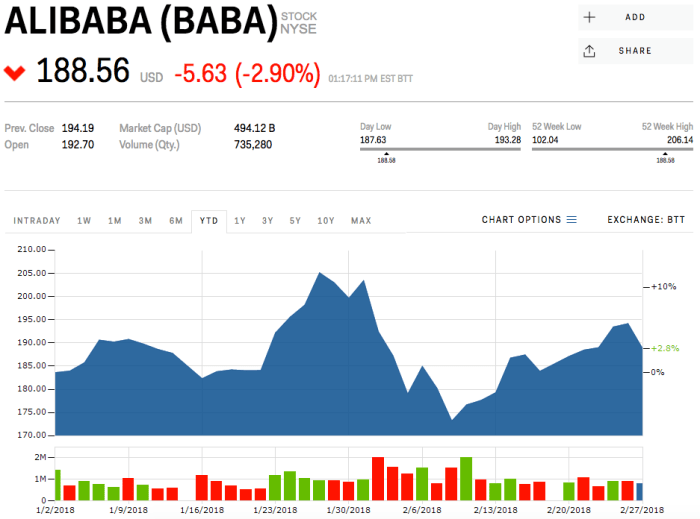

Investor Sentiment and Alibaba Stock, Alibaba price stock

Source: businessinsider.com

Current investor sentiment towards Alibaba is mixed, reflecting the ongoing uncertainties surrounding regulatory changes in China and the company’s competitive landscape. While some investors remain bullish on Alibaba’s long-term growth potential, others are more cautious due to the recent regulatory headwinds.

News articles highlighting successful product launches or strong earnings reports tend to boost investor confidence and drive up the stock price. Conversely, reports on increased regulatory scrutiny or negative financial news can quickly shift investor sentiment towards bearishness, leading to price declines. For example, a major antitrust ruling against Alibaba could significantly impact investor sentiment.

A hypothetical investment strategy might involve a diversified approach, combining long-term holdings with short-term trading opportunities based on news events and short-term price fluctuations. A bullish investor might maintain a long position, while a bearish investor might consider short selling or hedging strategies.

Alibaba’s Future Outlook and Stock Price Projections

Projecting Alibaba’s stock price for the next 12 months is inherently speculative. However, considering its strong market position in China, ongoing investments in technology, and potential expansion into new markets, a moderate price increase is plausible. Assuming a stable regulatory environment and continued growth in key business segments, a price range between $95 and $110 per share within the next 12 months is a possible scenario.

This projection is based on the assumption of continued growth in e-commerce and cloud computing, along with a resolution of major regulatory concerns.

Factors that could drive future growth include successful innovation in areas like artificial intelligence and the expansion into international markets. Conversely, factors that could lead to price declines include further regulatory tightening in China, increased competition, or a significant downturn in the global economy. Geopolitical risks, such as escalating trade tensions between the US and China, could also negatively impact Alibaba’s stock performance.

Essential Questionnaire: Alibaba Price Stock

What are the major risks associated with investing in Alibaba stock?

Major risks include regulatory uncertainty in China, geopolitical tensions impacting the global economy, increased competition, and fluctuations in the Chinese currency.

How does Alibaba compare to its main competitors in terms of market capitalization?

Alibaba’s market capitalization fluctuates but generally ranks among the largest in the global e-commerce and technology sectors, though its relative position to competitors like Amazon and Tencent varies.

Where can I find reliable real-time data on Alibaba’s stock price?

Major financial news websites and stock market data providers (e.g., Yahoo Finance, Google Finance, Bloomberg) offer real-time and historical data on Alibaba’s stock price.

What is Alibaba’s dividend policy?

Alibaba’s dividend policy has historically been less focused on consistent dividend payouts, prioritizing reinvestment in growth initiatives. Check their investor relations for the most up-to-date information.