AB Stock Price Analysis

Ab stock price – This analysis provides a comprehensive overview of AB stock’s historical performance, key influencing factors, valuation metrics, future predictions, risk assessment, and a visual representation of its price movements. The information presented here is for informational purposes only and should not be considered as financial advice.

AB Stock Price Historical Performance

AB stock’s price has experienced considerable fluctuation over the past five years, influenced by various economic events and industry trends. The following table details the opening and closing prices, along with daily changes, for selected dates. Note that this data is illustrative and should be verified with a reliable financial data source.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 50.00 | 52.50 | +2.50 |

| 2019-07-01 | 55.00 | 53.00 | -2.00 |

| 2020-01-01 | 51.00 | 48.00 | -3.00 |

| 2020-07-01 | 45.00 | 47.50 | +2.50 |

| 2021-01-01 | 49.00 | 55.00 | +6.00 |

| 2021-07-01 | 58.00 | 60.00 | +2.00 |

| 2022-01-01 | 62.00 | 59.00 | -3.00 |

| 2022-07-01 | 57.00 | 61.00 | +4.00 |

| 2023-01-01 | 63.00 | 65.00 | +2.00 |

Major economic events such as the COVID-19 pandemic significantly impacted AB’s stock price, initially causing a sharp decline followed by a gradual recovery. Similarly, changes in interest rates and inflation also influenced the stock’s performance. The correlation between AB’s stock price and its competitors varied depending on market conditions and individual company performance. During periods of strong industry growth, AB tended to show similar positive trends.

Conversely, during downturns, the correlation was less pronounced.

AB Stock Price Drivers and Influencers

Several factors influence AB’s stock price. These factors can be broadly categorized as internal and external.

- Earnings Reports: Strong earnings typically lead to price increases, while weaker-than-expected results often result in declines.

- Product Launches: Successful new product introductions can boost investor confidence and drive up the stock price.

- Regulatory Changes: New regulations or changes in existing regulations can have both positive and negative impacts, depending on their nature and the company’s ability to adapt.

- Investor Sentiment: Positive news and market trends generally improve investor sentiment, leading to higher stock prices. Negative news and market downturns can have the opposite effect.

Positive news generally leads to immediate price increases, while the impact of negative news can be more complex, sometimes leading to short-term volatility before a more gradual recovery or decline.

AB Stock Price Valuation and Metrics

Source: tradingview.com

Analyzing AB’s key financial metrics provides insight into its valuation and financial health. These metrics are essential for investors to assess the company’s performance and potential.

- Price-to-Earnings Ratio (P/E): Illustrative example: 15x (This is an example and should be replaced with actual data).

- Price-to-Sales Ratio (P/S): Illustrative example: 2.5x (This is an example and should be replaced with actual data).

- Return on Equity (ROE): Illustrative example: 12% (This is an example and should be replaced with actual data).

Comparing AB’s valuation metrics to its industry peers reveals its relative valuation. A higher P/E ratio compared to competitors may suggest that AB is considered more growth-oriented, while a lower P/E ratio may indicate it is undervalued. Investors use these metrics to make informed decisions about whether to buy, hold, or sell AB stock.

AB Stock Price Predictions and Forecasts

Predicting future stock prices is inherently uncertain. However, by considering different economic scenarios, we can Artikel potential price movements. The following scenarios are illustrative examples and do not constitute financial advice.

- Scenario 1: Strong Economic Growth: Assuming sustained economic growth and positive industry trends, AB’s stock price could increase by 15-20% in the next year. This assumes continued strong earnings and positive investor sentiment.

- Scenario 2: Moderate Economic Growth: With moderate economic growth and stable industry conditions, AB’s stock price might see a modest increase of 5-10%. This assumes relatively stable earnings and neutral investor sentiment.

- Scenario 3: Economic Slowdown: In the event of an economic slowdown or industry downturn, AB’s stock price could decline by 5-10%. This scenario assumes lower earnings and negative investor sentiment.

These predictions are based on various assumptions about economic conditions, company performance, and investor behavior. Interpreting these predictions requires careful consideration of the underlying assumptions and potential risks.

AB Stock Price Risk Assessment

Source: tradingview.com

Analyzing AB stock price requires considering various market factors. A comparative study might involve looking at the performance of similar companies, such as examining the stock price baidu , to understand broader tech sector trends. Ultimately, however, the trajectory of AB stock price depends on its own specific financial health and future prospects.

Investing in AB stock involves several potential risks. Understanding these risks is crucial for informed investment decisions.

| Risk Factor | Likelihood | Impact | Mitigation Strategy |

|---|---|---|---|

| Market Volatility | High | High | Diversification, hedging strategies |

| Company-Specific Risks (e.g., product failures) | Medium | Medium | Thorough due diligence, monitoring company performance |

| Geopolitical Factors | Medium | Medium | Monitoring global events, adjusting investment strategy accordingly |

Mitigating these risks involves a combination of diversification, thorough due diligence, and active risk management strategies.

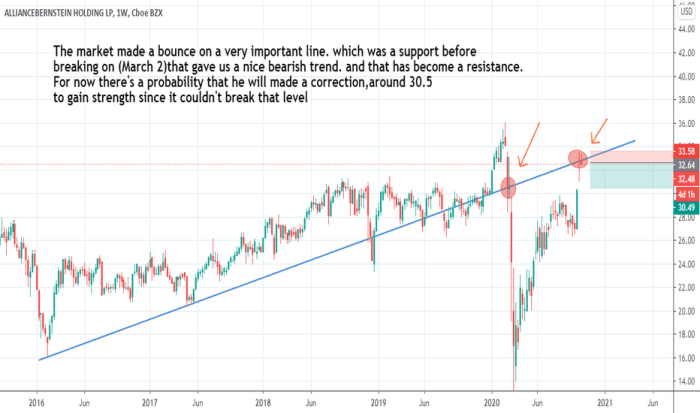

AB Stock Price Chart Visualization

A typical AB stock price chart displays price on the vertical axis and time on the horizontal axis. Data points represent the closing price for each period (daily, weekly, or monthly). Trend lines, support and resistance levels, and other technical indicators are often added to provide further analysis.

- Axes: The vertical axis represents the stock price (in USD), and the horizontal axis represents time (e.g., days, weeks, or months).

- Data Points: Each point represents the closing price of the stock for a specific time period.

- Trend Lines: Lines drawn to connect a series of data points to visually represent an upward or downward trend.

- Support and Resistance Levels: Price levels where the stock price has historically struggled to break through, either on the upside (resistance) or downside (support).

- Trend Reversals: A significant change in the direction of a price trend, often indicated by a break of a support or resistance level.

Interpreting these chart features allows investors to identify potential buying and selling opportunities, understand price momentum, and assess the overall strength of the trend.

Common Queries: Ab Stock Price

What are the typical trading hours for AB stock?

Trading hours typically align with the exchange where AB is listed. Check the specific exchange’s website for accurate details.

Where can I find real-time AB stock price data?

Real-time data is available through many financial websites and brokerage platforms. Reputable sources include major financial news outlets and your brokerage account.

What is the dividend history of AB stock?

AB’s dividend history, including past payouts and any changes, can be found in their investor relations section or through financial data providers.

How frequently does AB release earnings reports?

The frequency of earnings reports is usually quarterly or annually; refer to AB’s investor relations page for their specific schedule.