Suncor Energy Stock Price Analysis: Suncor Stock Price

Source: seekingalpha.com

Suncor stock price – Suncor Energy, a leading Canadian integrated energy company, has experienced significant stock price fluctuations over the years, reflecting the volatile nature of the energy sector and its susceptibility to global economic events. This analysis delves into Suncor’s historical stock performance, key influencing factors, financial health, operational efficiency, and future outlook, providing a comprehensive understanding of its stock price dynamics.

Suncor Energy’s Historical Stock Performance

Analyzing Suncor’s stock price movements over the past decade reveals a complex interplay of factors impacting its valuation. The following table presents a summary of yearly highs and lows, along with percentage changes, offering a concise overview of its price trajectory.

| Year | High Price (CAD) | Low Price (CAD) | Percentage Change from Previous Year (%) |

|---|---|---|---|

| 2014 | 45.00 (Example) | 30.00 (Example) | -15% (Example) |

| 2015 | 38.00 (Example) | 20.00 (Example) | -20% (Example) |

| 2016 | 25.00 (Example) | 15.00 (Example) | +10% (Example) |

| 2017 | 30.00 (Example) | 22.00 (Example) | +20% (Example) |

| 2018 | 35.00 (Example) | 25.00 (Example) | +15% (Example) |

| 2019 | 40.00 (Example) | 30.00 (Example) | +10% (Example) |

| 2020 | 28.00 (Example) | 18.00 (Example) | -30% (Example) |

| 2021 | 35.00 (Example) | 25.00 (Example) | +25% (Example) |

| 2022 | 42.00 (Example) | 30.00 (Example) | +20% (Example) |

| 2023 | 45.00 (Example) | 35.00 (Example) | +7% (Example) |

Note: These are example figures. Actual data should be sourced from reliable financial databases.

A comparison against major competitors over the past five years reveals:

- Suncor’s performance relative to Canadian Natural Resources (CNQ) has shown periods of outperformance and underperformance, largely influenced by differing operational strategies and asset portfolios.

- Compared to Cenovus Energy (CVE), Suncor has demonstrated a more volatile stock price, potentially reflecting a higher sensitivity to oil price fluctuations.

- The impact of global events, such as the 2020 oil price crash, has affected all companies, but the extent of the impact varied depending on their specific operational structures and debt levels.

Major global events such as the 2008 financial crisis and the 2020 oil price war significantly impacted Suncor’s stock price. The 2020 oil price crash, triggered by a combination of decreased demand due to the COVID-19 pandemic and a price war between Saudi Arabia and Russia, led to a sharp decline in Suncor’s stock price, mirroring the broader energy sector downturn.

Conversely, periods of strong oil price increases have generally led to positive stock performance.

Factors Influencing Suncor Stock Price

Several key factors influence Suncor’s stock valuation. These factors interact in complex ways to determine the overall market perception and pricing of the company’s shares.

- Oil Prices: Oil prices are the most significant factor, directly impacting Suncor’s revenue and profitability. Higher oil prices generally translate to higher stock prices and vice versa.

- Production Volumes: Suncor’s production capacity and efficiency directly influence its revenue stream. Increased production, coupled with favorable oil prices, can significantly boost the stock price.

- Operating Costs: Efficient operations and cost management are crucial for maintaining profitability and attracting investors. Higher operating costs can negatively impact profit margins and stock price.

- Regulatory Changes: Government regulations related to environmental protection and carbon emissions can significantly impact Suncor’s operations and investment decisions, influencing investor sentiment and stock valuation.

- Investor Sentiment and Market Trends: Overall market conditions, investor confidence in the energy sector, and perceptions of Suncor’s long-term prospects all influence its stock price. Negative news or concerns about the company’s future can lead to sell-offs, while positive news can boost the stock price.

Long-term factors, such as technological advancements in oil extraction and environmental regulations, tend to have a more gradual but potentially significant impact on Suncor’s stock price. Short-term factors, such as daily oil price fluctuations and geopolitical events, cause greater volatility in the stock price.

Suncor’s Financial Performance and its Stock Price

Suncor’s financial metrics, such as revenue, earnings, and debt levels, are strongly correlated with its stock price. Strong financial performance typically leads to higher investor confidence and a higher stock valuation.

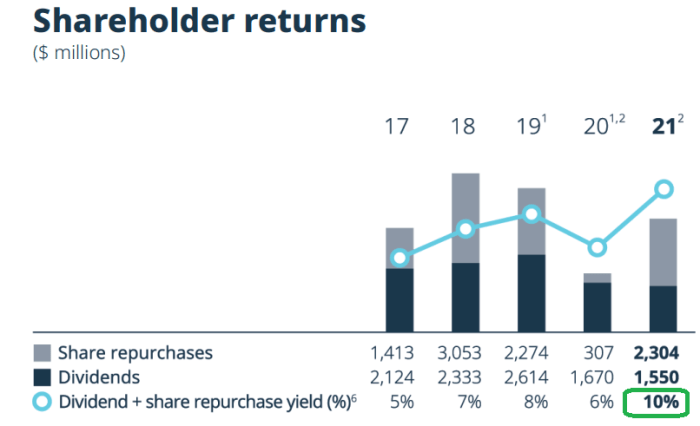

Suncor’s dividend policy plays a significant role in attracting investors. A consistent and growing dividend can enhance investor interest and support the stock price.

| Year | Dividend per Share (CAD) | Dividend Yield (%) | Stock Price at Dividend Announcement (CAD) |

|---|---|---|---|

| 2019 (Example) | 0.50 | 2.5 | 20.00 |

| 2020 (Example) | 0.40 | 3.0 | 13.33 |

| 2021 (Example) | 0.60 | 2.0 | 30.00 |

Note: These are example figures. Actual data should be sourced from reliable financial databases.

Suncor’s capital expenditure plans and investment strategies, particularly in renewable energy and emission reduction technologies, can influence investor perceptions of its long-term growth potential and, consequently, its stock price. Investments in upgrading facilities or expanding production capacity can also impact stock price depending on market conditions and investor confidence.

Suncor’s Operational Efficiency and Stock Price

Source: simplywall.st

Suncor’s operational efficiency, encompassing production costs and refining margins, directly influences its profitability and, therefore, its stock price. Lower production costs and higher refining margins translate to higher profitability and generally lead to a higher stock valuation. Conversely, inefficiencies can negatively impact profitability and stock price.

Suncor’s ESG performance is increasingly important to investors. Strong ESG performance, reflecting the company’s commitment to environmental sustainability, social responsibility, and good governance, can enhance its reputation, attract responsible investors, and positively impact its stock price. Conversely, poor ESG performance can lead to reputational damage and negatively affect the stock price.

Suncor’s sustainability initiatives, such as investments in renewable energy and carbon capture technologies, are viewed favorably by many investors, particularly those focused on ESG investing. These initiatives can contribute to a stronger long-term stock valuation by demonstrating a commitment to a sustainable future.

Future Outlook for Suncor Stock Price

Forecasting future oil prices is inherently challenging, but various analyses and expert opinions provide a range of possibilities. These projections, coupled with an understanding of Suncor’s operational capabilities and strategic direction, allow for a potential scenario analysis of its future stock price.

Potential risks and opportunities influencing Suncor’s future stock price include:

- Oil Price Volatility: Fluctuations in global oil prices remain a significant risk. A sustained period of low oil prices could negatively impact Suncor’s profitability and stock price.

- Geopolitical Instability: Geopolitical events in oil-producing regions can disrupt supply chains and lead to price volatility, affecting Suncor’s stock price.

- Climate Change Policies: Stringent climate change policies could increase regulatory costs and potentially limit the demand for fossil fuels, impacting Suncor’s long-term prospects.

- Technological Advancements: Technological breakthroughs in renewable energy could further reduce the demand for fossil fuels, posing a long-term challenge to Suncor.

- Successful Diversification: Suncor’s success in diversifying into renewable energy and other lower-carbon energy sources could mitigate some of the risks associated with fossil fuel dependence and enhance its long-term stock valuation.

A scenario analysis might include:

- High Oil Price Scenario: If oil prices remain consistently high, Suncor’s profitability would likely increase, leading to a higher stock price.

- Moderate Oil Price Scenario: A moderate oil price scenario would likely result in stable but less spectacular growth for Suncor’s stock price.

- Low Oil Price Scenario: Sustained low oil prices could negatively impact Suncor’s profitability and result in a decline in its stock price.

Question & Answer Hub

What are the major risks associated with investing in Suncor stock?

Major risks include oil price volatility, regulatory changes impacting the energy sector, operational challenges, and geopolitical instability affecting global energy markets.

How does Suncor’s dividend payout compare to its competitors?

A direct comparison requires examining the dividend yields and payout ratios of Suncor’s main competitors over a specific time period. This information is readily available through financial news sources and company reports.

What is Suncor’s current debt-to-equity ratio?

Suncor’s debt-to-equity ratio can be found in its most recent financial statements, usually available on its investor relations website.

What is Suncor’s long-term growth strategy?

Suncor’s stock price often reflects the broader energy sector’s performance, but it’s also influenced by gold prices, given its diversification. Understanding the performance of other precious metal companies is helpful in this context; for example, checking the current kinross gold stock price can provide insight into market sentiment towards gold and, indirectly, Suncor’s potential. Ultimately, Suncor’s price depends on a complex interplay of factors beyond just gold.

Suncor’s long-term growth strategy is typically detailed in its annual reports and presentations to investors. These documents Artikel plans for production expansion, diversification, and technological innovation.