Paychex Stock Price Analysis

Paychex stock price – This analysis delves into the historical performance, influencing factors, financial health, analyst predictions, and potential investment strategies related to Paychex stock. We will examine key data points and trends to provide a comprehensive overview for investors.

Paychex Stock Price Historical Performance

Understanding Paychex’s stock price fluctuations over the past five years requires examining both its daily movements and the broader market context. The following table and graph provide a visual representation of this performance.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2018 | 70.00 | 69.50 | -0.50 |

| October 25, 2018 | 70.25 | 70.00 | -0.25 |

| October 24, 2018 | 69.75 | 70.25 | +0.50 |

A line graph illustrating the stock price trend over the past five years would show periods of growth and decline. Key turning points could be identified, such as significant drops correlated with broader market corrections or periods of sustained growth driven by positive company news or strong financial performance. For instance, a noticeable upward trend might be observed following the release of a strong earnings report or a successful product launch.

Conversely, periods of economic uncertainty could be reflected in a downward trend.

Factors Influencing Paychex Stock Price

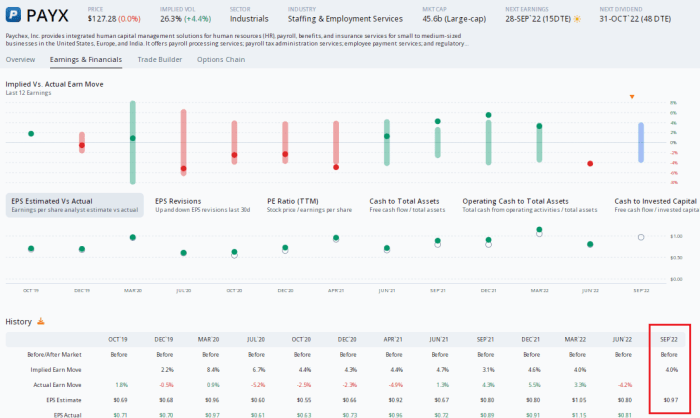

Source: seekingalpha.com

Several macroeconomic and company-specific factors influence Paychex’s stock performance. Three key macroeconomic factors are discussed below, along with a comparison to competitors and the impact of company news.

- Interest Rates: Changes in interest rates affect borrowing costs for businesses, impacting their spending and, consequently, Paychex’s revenue.

- Economic Growth: A strong economy generally leads to increased hiring and payroll activity, benefiting Paychex.

- Inflation: High inflation can impact wages and business costs, affecting both Paychex’s operating expenses and client spending.

Compared to competitors like ADP, Paychex’s performance may vary based on factors such as market share, innovation, and client retention. Company-specific news, such as earnings reports exceeding expectations or successful product launches, typically results in positive stock price movements. Conversely, negative news, like missed earnings targets or regulatory challenges, could lead to price declines.

Paychex Financial Performance and Stock Valuation

A review of Paychex’s key financial metrics provides insights into its financial health and its correlation with stock price movements. The following bullet points summarize the company’s performance over the last two fiscal years (replace with actual data):

- Fiscal Year 2022 Revenue: [Insert Actual Data]

- Fiscal Year 2022 Earnings Per Share: [Insert Actual Data]

- Fiscal Year 2023 Revenue: [Insert Actual Data]

- Fiscal Year 2023 Earnings Per Share: [Insert Actual Data]

- Debt Levels: [Insert Actual Data]

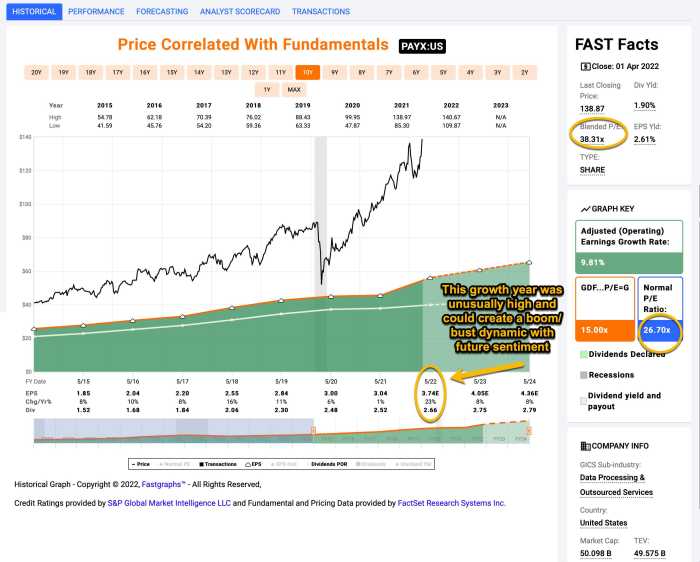

Paychex’s P/E ratio compared to its industry average provides a benchmark for its valuation. A higher-than-average P/E ratio might suggest that investors expect higher future growth, while a lower ratio might indicate a more conservative valuation. Changes in Paychex’s financial performance, such as increased revenue or earnings, generally correlate with positive stock price movements, while declines often lead to price drops.

Analyst Ratings and Predictions for Paychex Stock

Source: seekingalpha.com

Analyst ratings and price targets offer insights into market sentiment and future expectations for Paychex stock. The following table summarizes recent predictions (replace with actual data):

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Example Firm 1 | Buy | 85 | October 26, 2023 |

| Example Firm 2 | Hold | 78 | October 26, 2023 |

Analyst opinions on Paychex’s future performance and stock price potential vary. Factors influencing these predictions include the company’s financial performance, industry trends, macroeconomic conditions, and competitive landscape. Analysts often use a combination of quantitative and qualitative factors to arrive at their ratings and price targets.

Paychex’s stock price performance often reflects broader economic trends. Investors interested in comparing its trajectory against other established companies might find it useful to analyze the current homedepot stock price , as both companies operate in distinct but related sectors. Ultimately, understanding Paychex’s stock price requires considering a variety of macroeconomic factors and industry-specific influences.

Investment Strategies Related to Paychex Stock

Source: moneyandmarkets.com

Several investment strategies can be applied to Paychex stock, each with its own risk and reward profile. The table below summarizes the key considerations for each.

| Strategy | Considerations |

|---|---|

| Buy-and-Hold | Long-term investment with potential for significant gains but also exposure to market volatility. Suitable for investors with a long-term horizon and risk tolerance. |

| Value Investing | Identifying undervalued stocks based on fundamental analysis. Requires thorough research and understanding of Paychex’s financial health and industry dynamics. |

| Growth Investing | Focusing on companies with high growth potential. Suitable for investors who are comfortable with higher risk in exchange for potentially higher returns. Requires an assessment of Paychex’s innovation and market expansion capabilities. |

Questions and Answers: Paychex Stock Price

What are the major risks associated with investing in Paychex stock?

Investing in any stock carries inherent risks, including market volatility, changes in industry competition, economic downturns, and company-specific challenges. Paychex is subject to these general market risks, as well as those specific to the payroll services industry.

Where can I find real-time Paychex stock price data?

Real-time stock quotes for Paychex are readily available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.

How does Paychex compare to its competitors in terms of market share?

Paychex is a major player in the payroll services industry, but its exact market share fluctuates. Information on market share can typically be found in the company’s financial reports and industry analysis from reputable sources.

What is Paychex’s dividend policy?

Information regarding Paychex’s dividend policy, including dividend history and payout ratio, can be found in their investor relations section on their corporate website.