NVIDIA Stock Price: A Comprehensive Analysis

Source: trading-education.com

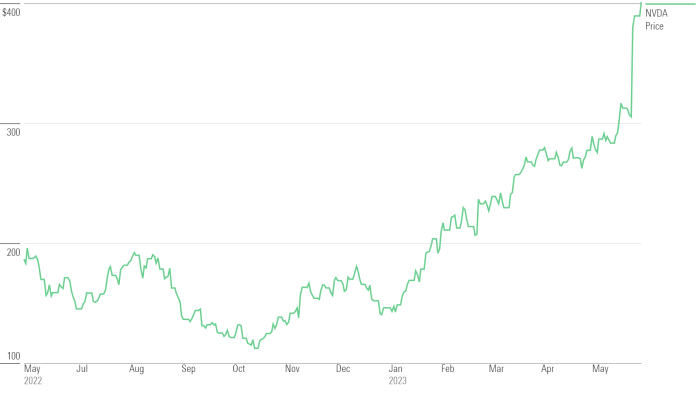

Nvda stock price target – NVIDIA (NVDA) has experienced remarkable growth in recent years, driven primarily by the burgeoning demand for its high-performance computing solutions in artificial intelligence, gaming, and data centers. This analysis delves into the historical performance of NVDA stock, examines the factors influencing its price target, and assesses the potential risks and rewards for investors.

NVIDIA Stock Price Historical Performance

Source: paisakit.com

Over the past five years, NVDA’s stock price has exhibited a strong upward trend, punctuated by periods of volatility. The company’s innovative technologies and strategic market positioning have been key drivers of this growth. However, macroeconomic factors and broader market sentiment have also played a significant role.

| Year | Yearly High | Yearly Low | Closing Price |

|---|---|---|---|

| 2023 | $481.87 (Estimate) | $107.00 (Estimate) | $ (Estimate) |

| 2022 | $318.67 | $107.00 | $146.46 |

| 2021 | $346.47 | $104.00 | $295.65 |

| 2020 | $189.69 | $50.75 | $127.64 |

| 2019 | $231.85 | $106.10 | $125.78 |

Major market events such as the COVID-19 pandemic initially caused a downturn, but the subsequent surge in demand for remote work and gaming solutions fueled a significant recovery. Similarly, fluctuations in the broader technology sector have influenced NVDA’s stock price. The high volatility is evident in the significant difference between yearly highs and lows. For example, in 2022, the difference between the high and low was over $211.

This reflects the sensitivity of the stock to market sentiment and technological advancements.

Factors Influencing NVDA Stock Price Target

Several key factors contribute to the setting of NVDA’s price target. Analysts carefully consider a range of financial and market indicators to arrive at their projections.

Key financial metrics like revenue growth, earnings per share (EPS), and profit margins are crucial indicators of the company’s financial health and future performance. Technological advancements, particularly in AI and data centers, are significant drivers of NVDA’s growth. The increasing adoption of AI across various industries presents a substantial growth opportunity for the company. Macroeconomic factors, such as interest rate changes and inflation, influence investor sentiment and overall market conditions, which in turn impact NVDA’s valuation.

Industry-specific trends, such as competition and technological disruptions, also play a role in shaping price targets.

Analyst Price Targets and Ratings, Nvda stock price target

Various financial institutions provide price targets and ratings for NVDA stock, reflecting their assessment of the company’s future prospects. These targets are often based on a combination of quantitative and qualitative factors.

| Firm Name | Target Price | Rating | Date |

|---|---|---|---|

| Morgan Stanley | $500 | Overweight | October 26, 2023 (Example) |

| Goldman Sachs | $450 | Buy | October 26, 2023 (Example) |

| JPMorgan Chase | $400 | Neutral | October 26, 2023 (Example) |

Analysts typically employ a variety of valuation methodologies, including discounted cash flow (DCF) analysis and comparable company analysis, to arrive at their price targets. The range of price targets reflects the inherent uncertainty in predicting future performance. A consensus forecast can be derived by averaging the targets from multiple analysts, providing a general market expectation.

Valuation Methods and Their Implications

Different valuation methods yield varying price targets for NVDA, reflecting the different assumptions and inputs used in each approach. Understanding these methods is crucial for interpreting analyst forecasts.

The discounted cash flow (DCF) model estimates the present value of future cash flows, while the price-to-earnings (P/E) ratio compares the stock price to its earnings per share. Other methods include comparing NVDA to similar companies and considering its market share and growth prospects. Discrepancies between valuation methods often arise due to differences in assumptions about future growth rates, discount rates, and risk factors.

A comprehensive valuation requires considering multiple approaches and carefully evaluating the underlying assumptions.

Predicting the NVDA stock price target is always a challenge, requiring careful consideration of various market factors. Understanding the performance of other stocks can offer a broader perspective; for instance, checking the current ifci ltd stock price might provide insight into broader market trends. Ultimately, however, a comprehensive analysis is needed to accurately forecast the future trajectory of the NVDA stock price target.

Risk Factors and Potential Upside/Downside

Several risks could impact NVDA’s stock price. It is important to consider both potential upside and downside scenarios.

- Potential Risks: Increased competition, macroeconomic slowdown, supply chain disruptions, regulatory changes, technological obsolescence.

- Potential Upside Scenarios: Continued strong growth in AI, successful expansion into new markets, technological breakthroughs, strategic acquisitions.

- Potential Downside Scenarios: Lower-than-expected demand for its products, failure to innovate, increased competition leading to reduced market share, significant macroeconomic downturn.

Competitive Landscape and Market Share

Source: arcpublishing.com

NVIDIA operates in a competitive landscape, and understanding its market position is crucial for assessing its future prospects.

| Company Name | Market Share (Estimate) | Key Strengths | Key Weaknesses |

|---|---|---|---|

| NVIDIA | 40% (Example) | Strong R&D, leading market position in GPUs, extensive ecosystem | High dependence on a few key customers, potential for increased competition |

| AMD | 25% (Example) | Competitive pricing, strong CPU business | Smaller market share in GPUs |

| Intel | 15% (Example) | Strong brand recognition, broad product portfolio | Relatively weak GPU market share |

The competitive pressure from companies like AMD and Intel, along with the emergence of new players, could impact NVDA’s market share and future growth. Maintaining its technological leadership and expanding into new markets are critical for NVDA to sustain its strong performance.

Common Queries: Nvda Stock Price Target

What are the major risks associated with investing in NVDA?

Major risks include competition from other chipmakers, dependence on a few key customers, economic downturns impacting demand, and potential supply chain disruptions.

How does NVDA’s involvement in AI affect its stock price?

NVDA’s significant role in AI hardware and software development significantly impacts its stock price. Strong growth in AI applications tends to boost NVDA’s valuation, while setbacks in the AI sector could negatively affect its stock.

What is the difference between a price target and a stock rating?

A price target is a prediction of the future price of a stock, while a stock rating (e.g., buy, sell, hold) reflects an analyst’s overall opinion on the stock’s investment potential.

Where can I find real-time NVDA stock price information?

Real-time NVDA stock prices are available from major financial websites and brokerage platforms.