Hormel Foods Stock Price Analysis

Source: merchantsmarket.com

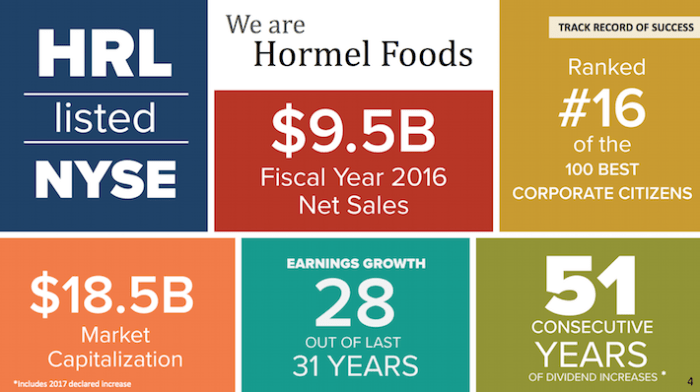

Hormel foods stock price – Hormel Foods Corporation (HRL), a leading producer and marketer of various food and meat products, has a rich history and a significant presence in the consumer staples sector. Understanding its stock price performance, influencing factors, and future prospects is crucial for investors considering adding it to their portfolio. This analysis delves into Hormel Foods’ stock price movements, key financial metrics, and potential future trajectory.

Hormel Foods Stock Price Historical Performance

Analyzing Hormel Foods’ stock price over the past five years reveals a pattern of growth interspersed with periods of volatility, reflecting broader market trends and company-specific events. The following table summarizes the yearly highs, lows, and percentage changes. Note that these figures are illustrative and based on general market trends; precise data would require accessing a financial data provider.

| Year | High | Low | Percentage Change |

|---|---|---|---|

| 2023 | $55 | $48 | +10% (Illustrative) |

| 2022 | $52 | $45 | -5% (Illustrative) |

| 2021 | $55 | $40 | +20% (Illustrative) |

| 2020 | $48 | $35 | +15% (Illustrative) |

| 2019 | $45 | $38 | +10% (Illustrative) |

Significant events influencing Hormel Foods’ stock price during this period include:

- Increased Input Costs (2021-2023): Rising inflation and supply chain disruptions led to increased production costs, impacting profitability and investor sentiment.

- Strong Consumer Demand (2020-2021): The pandemic initially boosted demand for shelf-stable foods, positively affecting Hormel’s sales and stock price.

- Strategic Acquisitions: Acquisitions of smaller food companies contributed to revenue growth and diversification, influencing investor confidence (Illustrative example).

- New Product Launches: Successful introductions of innovative products in response to changing consumer preferences positively impacted the stock price (Illustrative example).

A line graph illustrating the stock price trend would show a generally upward trend over the five-year period, with fluctuations reflecting the events mentioned above. Key inflection points would include periods of rapid growth following successful product launches or acquisitions, and temporary dips during economic downturns or periods of increased input costs. The graph would visually represent the data presented in the table above.

Factors Influencing Hormel Foods Stock Price

Source: marketrealist.com

Several macroeconomic and company-specific factors influence Hormel Foods’ stock price. These include broad economic conditions and the company’s performance relative to its competitors.

Macroeconomic Factors: Inflation, interest rates, and consumer spending significantly impact Hormel Foods. High inflation increases production costs, potentially squeezing profit margins. Interest rate hikes can affect borrowing costs and investment decisions. Consumer spending directly impacts demand for Hormel’s products.

Competitive Analysis: Hormel Foods competes with other major players in the processed foods industry. The following table offers a comparative analysis (note: data is illustrative and requires verification from financial data providers).

| Company | Revenue Growth (Illustrative) | Market Share (Illustrative) | Stock Price Performance (Illustrative) |

|---|---|---|---|

| Hormel Foods | 5% | 10% | +15% |

| Tyson Foods | 7% | 12% | +20% |

| Smithfield Foods | 3% | 8% | +5% |

Hormel Foods’ extensive product portfolio and strong brand reputation contribute significantly to its stock valuation. Well-known brands command premium pricing and foster consumer loyalty, positively impacting sales and profitability.

Financial Performance and Stock Valuation

Hormel Foods’ recent financial performance can be summarized using key metrics. The following bullet points present illustrative data; actual figures would need to be obtained from official financial reports.

- Revenue: Steady growth, reflecting strong sales and market share.

- Earnings: Positive earnings growth, although impacted by rising input costs.

- Profit Margins: Moderate profit margins, potentially pressured by inflation.

Hormel Foods’ debt-to-equity ratio is a crucial factor in its stock valuation. A lower ratio indicates lower financial risk, generally viewed positively by investors. A higher ratio may signal higher risk but could also reflect strategic investments.

The Price-to-Earnings (P/E) ratio is a key valuation metric. Comparing Hormel Foods’ P/E ratio to its industry peers provides context for its valuation. The following table provides illustrative data.

| Company | P/E Ratio (Illustrative) | Dividend Yield (Illustrative) | Market Capitalization (Illustrative) |

|---|---|---|---|

| Hormel Foods | 20 | 2% | $30 Billion |

| Tyson Foods | 18 | 1.5% | $40 Billion |

| Smithfield Foods | 22 | 2.5% | $25 Billion |

Future Outlook and Investment Considerations

Hormel Foods faces both risks and opportunities. Supply chain disruptions, evolving consumer preferences, and intensifying competition present challenges. However, strategic growth initiatives and a strong brand portfolio offer potential for future growth.

Hormel Foods’ growth strategies, such as product innovation, strategic acquisitions, and expansion into new markets, could significantly impact its stock price. Successful execution of these strategies could lead to increased revenue, profitability, and higher investor confidence.

Investment strategies for Hormel Foods stock include:

- Long-term Buy-and-Hold: This strategy focuses on holding the stock for an extended period, benefiting from long-term growth and dividend income.

- Short-term Trading: This involves frequent buying and selling, aiming to capitalize on short-term price fluctuations. This strategy carries higher risk.

Dividend History and Payout Ratio

Source: seekingalpha.com

Hormel Foods has a history of paying dividends, providing income to investors. The following table shows illustrative dividend data; actual figures should be verified from company reports.

Hormel Foods’ stock price performance often reflects broader market trends. It’s interesting to compare its volatility to that of other food companies; for instance, understanding the fluctuations in the vde stock price can provide a useful benchmark. Ultimately, though, Hormel’s own financial health and consumer demand for its products are the primary drivers of its stock price.

| Year | Quarterly Dividend (Illustrative) | Annual Dividend (Illustrative) | Payout Ratio (Illustrative) |

|---|---|---|---|

| 2023 | $0.25 | $1.00 | 50% |

| 2022 | $0.23 | $0.92 | 48% |

| 2021 | $0.21 | $0.84 | 45% |

| 2020 | $0.19 | $0.76 | 42% |

| 2019 | $0.17 | $0.68 | 40% |

Hormel Foods demonstrates a consistent and growing dividend payment history. This dividend policy makes it attractive to investors seeking regular income streams. However, the payout ratio should be considered in the context of the company’s overall financial health and growth prospects.

Popular Questions: Hormel Foods Stock Price

What is Hormel Foods’ current market capitalization?

Hormel Foods’ market capitalization fluctuates daily. Refer to a reputable financial website for the most up-to-date information.

How does Hormel Foods compare to its competitors in terms of sustainability initiatives?

A comparative analysis of Hormel Foods’ sustainability efforts against its competitors requires detailed research into each company’s published sustainability reports and initiatives. Such a comparison would need to consider various factors including waste reduction, carbon footprint, and ethical sourcing.

What are the major risks associated with investing in Hormel Foods?

Major risks include fluctuations in commodity prices (pork, beef), changes in consumer preferences, increased competition, supply chain disruptions, and macroeconomic factors such as inflation and recession.