Understanding Cost Stock Price Today

The “cost stock price today” refers to the current market price of a particular stock, reflecting the price at which buyers and sellers are willing to transact. Understanding this price is crucial for investors to make informed decisions. This price is dynamically influenced by a multitude of factors, ranging from company performance to broader market sentiment.

Factors Influencing Stock Price

Numerous factors contribute to a stock’s current price. These include a company’s financial performance (earnings, revenue growth), industry trends, macroeconomic conditions (interest rates, inflation), investor sentiment, and news events (both positive and negative). For example, strong earnings reports generally lead to price increases, while negative news or economic downturns can cause prices to fall.

Costs Associated with Stock Ownership

Source: foolcdn.com

Owning stocks incurs various costs. These include brokerage commissions (fees charged by brokers for executing trades), regulatory fees, and taxes on capital gains (profits from selling stocks at a higher price than the purchase price). Furthermore, some investment accounts might charge annual fees or management fees.

Hypothetical Scenario Illustrating Cost Impact

Imagine an investor buys 100 shares of Company X at $50 per share, incurring a $10 brokerage fee. The total investment cost is $5010. If the investor later sells these shares at $60, the gross profit is $1000. However, after deducting a $20 brokerage fee and a 15% capital gains tax on the $1000 profit ($150), the net profit is $830.

Understanding cost stock price today requires considering various factors influencing market valuation. One example to illustrate this is the current performance of eose stock price , which highlights how individual company performance impacts overall market trends. Therefore, analyzing specific company stock prices, like EOSE, provides valuable insight into the broader context of cost stock price today.

This illustrates how transaction costs and taxes significantly reduce the overall return on investment.

Data Sources for Current Stock Prices

Reliable real-time stock price data is essential for informed investment decisions. Several reputable sources provide this information, each with its own strengths and weaknesses.

Reliable Sources for Stock Prices

Three reliable sources for obtaining real-time stock prices include major financial news websites, dedicated stock market data providers, and brokerage platforms. These sources vary in terms of data update frequency, the level of detail provided, and the types of data formats they offer. Accuracy is generally high, though minor discrepancies can occasionally occur due to data latency.

| Source Name | URL | Data Update Frequency | Data Reliability |

|---|---|---|---|

| Yahoo Finance | finance.yahoo.com | Real-time (with minor delays) | High |

| Google Finance | google.com/finance | Real-time (with minor delays) | High |

| Bloomberg | bloomberg.com | Real-time | Very High |

| TD Ameritrade | tdameritrade.com | Real-time | Very High |

These sources typically provide data in various formats, including CSV (Comma Separated Values), JSON (JavaScript Object Notation), and XML (Extensible Markup Language). The choice of format often depends on the intended use of the data, with CSV being common for spreadsheet applications and JSON/XML suitable for programmatic access.

Impact of Cost on Investment Decisions: Cost Stock Price Today

The current cost of a stock significantly influences both short-term and long-term investment strategies. Understanding this impact is vital for effective portfolio management and risk mitigation.

Cost’s Influence on Investment Strategies

In short-term trading, the cost of a stock relative to its perceived potential for quick gains is a major factor. Investors might prioritize stocks with lower entry costs to maximize potential profit margins, even if the long-term growth prospects are less certain. Long-term investors, on the other hand, typically focus on a company’s fundamental value and growth potential, often willing to pay a higher initial cost if they anticipate substantial long-term returns.

The role of cost in risk assessment involves carefully weighing the potential for losses against the potential for gains, considering transaction costs and market volatility.

Decision-Making Framework Considering Stock Cost

A simple decision-making framework might involve assessing a stock’s current price relative to its historical performance, projected earnings, and market valuation. This framework should also consider the investor’s risk tolerance and investment horizon. For example, an investor with a high-risk tolerance and a short-term horizon might be more willing to purchase a volatile stock at a higher cost if they believe it has the potential for quick gains, while a risk-averse investor with a long-term horizon might prioritize a more stable stock with lower cost, even if its growth potential is more moderate.

Cost as a Primary Driver of Investment Choices

In scenarios where market conditions are uncertain or volatile, cost can become a primary driver of investment choices. Investors might favor cheaper stocks as a defensive strategy during periods of economic downturn or market correction. Conversely, during periods of strong market growth, investors might be willing to pay a premium for stocks with high growth potential, even if the initial cost is higher.

Visualizing Stock Price Data

Visualizing stock price data enhances understanding of price trends and patterns. Various charting techniques effectively represent this data, each offering unique insights.

Methods for Visualizing Stock Price Data

Line graphs provide a simple overview of price movements over time, showing the closing price each day. Candlestick charts offer a richer representation, incorporating the opening, high, low, and closing prices for each period (typically a day). Each candlestick’s body indicates the range between the opening and closing prices, while the wicks represent the high and low prices for that period.

A green candlestick indicates a closing price higher than the opening price (an “up” day), while a red candlestick signifies a closing price lower than the opening price (a “down” day).

Creating a Line Graph in a Spreadsheet Program

To create a simple line graph of stock price data using a spreadsheet program like Microsoft Excel or Google Sheets, first input the date and corresponding closing price for each period in two adjacent columns. Then, select the data, go to the “Insert” tab, and choose “Line chart”. The program will automatically generate a line graph showing the price trend over time.

Customization options allow for adjusting chart titles, axis labels, and other visual elements.

Hypothetical Stock Price Chart Description, Cost stock price today

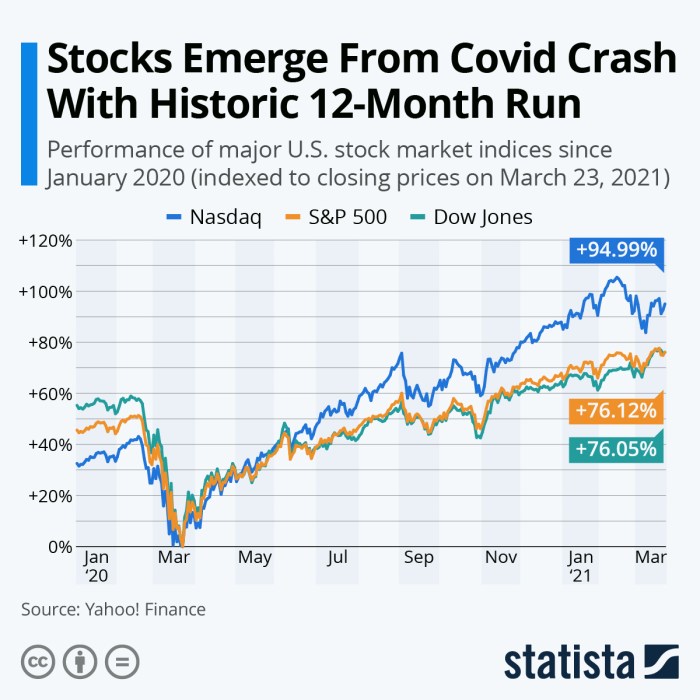

Source: statcdn.com

Imagine a hypothetical stock chart showing a gradual upward trend over six months. The initial three months display small fluctuations, with mostly green candlesticks indicating moderate gains. In the fourth month, a significant price drop is represented by a long red candlestick, followed by a period of consolidation with smaller price movements. The final two months show a strong recovery, with several long green candlesticks indicating substantial price increases, culminating in a higher closing price than at the beginning of the period.

This illustrates a typical pattern of market correction followed by a recovery.

External Factors Affecting Stock Price

Macroeconomic factors and news events significantly influence stock prices, often independently of a company’s specific performance.

Macroeconomic Factors and News Events

Interest rate changes, inflation rates, and economic growth significantly impact stock valuations. Rising interest rates generally lead to lower stock prices, as investors seek higher returns from fixed-income investments. High inflation erodes purchasing power and can negatively impact corporate profitability. Strong economic growth usually boosts stock prices, as companies experience increased demand and higher profits. News events, such as earnings reports, regulatory changes, and geopolitical developments, can trigger substantial price fluctuations.

Positive news, such as exceeding earnings expectations, tends to drive prices up, while negative news, such as a product recall or regulatory fines, can lead to price declines.

Impact of Different Types of News

Source: stockprice.com

Positive earnings reports typically result in immediate price increases, reflecting investor confidence in the company’s future performance. Negative regulatory changes, such as increased environmental regulations or antitrust lawsuits, can lead to significant price drops, as investors anticipate reduced profitability. Geopolitical events, such as wars or trade disputes, can create market uncertainty and cause widespread price fluctuations across various sectors.

Examples of News Events and Their Impact

For instance, a surprise announcement of a major technological breakthrough by a company often results in a sharp increase in its stock price. Conversely, a scandal involving a company’s executives might trigger a significant price drop, as investors lose confidence and sell their shares. Similarly, unexpected economic data releases, such as unexpectedly high inflation figures, can cause broad market declines.

FAQ Corner

What are some common mistakes investors make regarding stock costs?

Common mistakes include neglecting transaction fees, underestimating tax implications, and focusing solely on the price without considering the overall return on investment.

How frequently should I check stock prices?

The frequency depends on your investment strategy. Day traders check constantly, while long-term investors may only check periodically (e.g., monthly or quarterly).

Where can I find historical stock price data?

Many financial websites, including Yahoo Finance and Google Finance, offer historical stock price data. Brokerage accounts also usually provide this information.

What is the difference between a stock’s price and its value?

Price is what you pay for a stock at a given moment. Value is a more subjective assessment of what the stock is truly worth based on its fundamentals and future potential.