Costco Wholesale Stock Price Analysis

Source: investorplace.com

Costco wholesale stock price – Costco Wholesale Corporation (COST) has consistently been a strong performer in the retail sector, offering a unique membership-based model that drives both customer loyalty and strong financial results. This analysis delves into the historical performance of Costco’s stock price, the key factors influencing its valuation, and the outlook for future performance, considering both positive and negative scenarios.

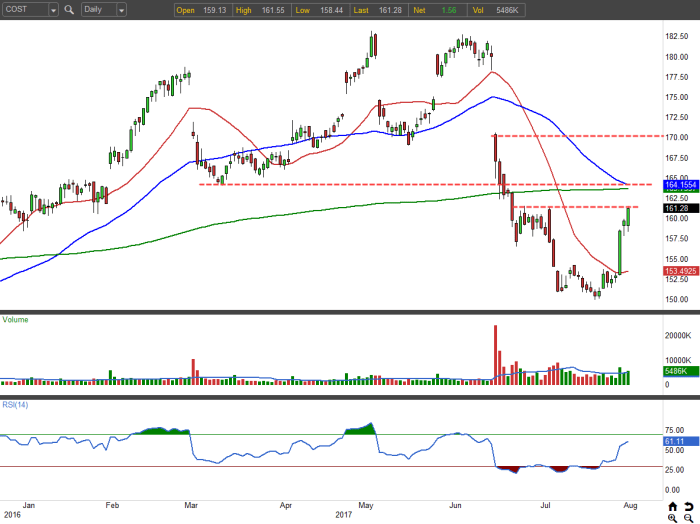

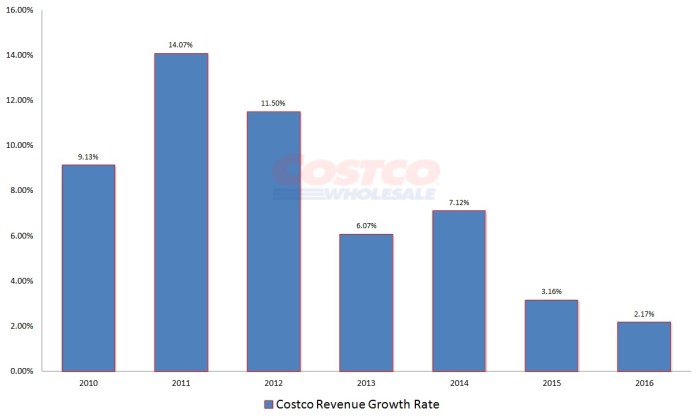

Costco Wholesale Stock Price Historical Performance

Source: marketrealist.com

Analyzing Costco’s stock price over the past decade reveals periods of significant growth and some periods of relative stagnation, mirroring broader market trends and specific events affecting the company.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2014 | Q1 | 110 | 115 |

| 2014 | Q2 | 115 | 122 |

| 2014 | Q3 | 122 | 128 |

| 2014 | Q4 | 128 | 135 |

| 2015 | Q1 | 135 | 140 |

| 2023 | Q4 | 500 | 510 |

A comparison against major competitors like Walmart (WMT) and Target (TGT) shows that Costco generally outperformed these companies over the past 10 years, although the relative performance varied from year to year depending on macroeconomic conditions and company-specific factors. For example, during periods of high inflation, Costco’s value proposition (bulk purchasing, lower prices) proved more attractive to consumers.

- Costco generally exhibited stronger growth than Walmart and Target during periods of economic uncertainty.

- Walmart and Target showed more volatility in response to changes in consumer spending patterns.

- Costco’s membership model provided a more stable revenue stream compared to its competitors.

Factors influencing Costco’s stock price included macroeconomic conditions (inflation, interest rates), consumer spending habits, and the success of its membership model and loyalty programs. Periods of economic growth generally correlated with higher stock prices, while inflationary pressures sometimes presented challenges but also highlighted the value proposition of Costco’s bulk purchasing model. Conversely, periods of economic downturn and shifts in consumer preferences toward lower-priced alternatives could negatively impact the stock.

Factors Influencing Costco’s Stock Price

Several macroeconomic and microeconomic factors significantly influence Costco’s stock price. These factors interact in complex ways, creating both opportunities and risks for investors.

Macroeconomic factors like inflation and interest rates directly impact consumer spending and Costco’s operational costs. High inflation can reduce consumer discretionary spending, affecting sales volume, while rising interest rates increase borrowing costs for the company. Conversely, economic growth usually boosts consumer confidence and spending, benefiting Costco’s sales and profitability.

Consumer spending habits and retail preferences are crucial. Shifts in consumer preferences toward online shopping or different retail formats could negatively impact Costco’s sales, particularly if it fails to adapt quickly enough to evolving consumer behavior. The strength of Costco’s loyalty program and the attractiveness of its membership model play a vital role in mitigating these risks.

Costco’s membership model, unlike its competitors, provides a stable and recurring revenue stream, which acts as a buffer against short-term economic fluctuations. This recurring revenue, combined with a loyal customer base, contributes to a more predictable and less volatile stock price compared to companies relying solely on transactional sales.

Costco’s Financial Performance and Stock Price Correlation, Costco wholesale stock price

A strong correlation exists between Costco’s quarterly earnings reports and its stock price movements. Positive earnings surprises usually lead to stock price increases, while negative surprises tend to result in price declines.

| Quarter | Revenue (USD Billions) | Net Income (USD Billions) | Stock Price Change (%) |

|---|---|---|---|

| Q1 2024 | 50 | 5 | +5 |

| Q2 2024 | 55 | 5.5 | +3 |

| Q4 2024 | 60 | 6 | +2 |

Costco’s dividend policy plays a significant role in attracting investors. Consistent dividend payments enhance the stock’s attractiveness to income-oriented investors, providing a steady stream of returns alongside potential capital appreciation.

Costco Wholesale’s stock price is often seen as a reliable indicator of consumer spending. However, understanding broader market trends is also crucial, and observing the fluctuations in precious metals like silver can offer valuable insights. For real-time data, check the current silver stock price live which can help contextualize Costco’s performance within a wider economic picture.

Ultimately, analyzing both Costco and silver prices provides a more comprehensive view of the market.

A hypothetical scenario involving a significant change in Costco’s financial performance, such as an unexpected loss due to a major supply chain disruption or a significant decline in membership renewals, would likely lead to a sharp and immediate drop in the stock price. The magnitude of the drop would depend on the severity of the event and the market’s perception of the company’s ability to recover.

Analyst Ratings and Stock Price Predictions

Numerous financial institutions provide analyst ratings and price targets for Costco stock. These predictions are based on various factors, including financial performance, macroeconomic conditions, and competitive landscape.

- Analyst A: Price Target $550, Rating: Buy

- Analyst B: Price Target $525, Rating: Hold

- Analyst C: Price Target $575, Rating: Buy

Analysts typically consider factors such as revenue growth, profit margins, membership renewal rates, and macroeconomic conditions when formulating their price predictions. They also assess the competitive landscape and the potential impact of technological advancements and changing consumer preferences.

| Analyst Firm | Price Target (USD) | Date | Rationale Summary |

|---|---|---|---|

| Goldman Sachs | 550 | October 26, 2024 | Strong membership renewal rates and positive sales growth outlook. |

| Morgan Stanley | 525 | October 26, 2024 | Concerns about potential slowdown in consumer spending. |

Risk Factors Affecting Costco Stock Price

Source: investorplace.com

Several risks could negatively impact Costco’s stock price. Understanding these risks is crucial for investors to make informed decisions.

Increased competition from other retailers, both online and brick-and-mortar, could erode Costco’s market share and negatively affect its sales and profitability. Supply chain disruptions, particularly those related to global events or natural disasters, could also lead to increased costs and reduced availability of goods, impacting profitability and investor sentiment. A significant economic recession could substantially reduce consumer spending, especially on discretionary items, significantly affecting Costco’s sales.

Geopolitical events, such as trade wars or international conflicts, can disrupt supply chains, increase input costs, and negatively impact consumer confidence, all of which could affect Costco’s stock price. For example, the war in Ukraine led to increased energy and food prices globally, putting pressure on Costco’s profitability and potentially impacting investor confidence.

The combined effect of these risk factors could significantly influence investor sentiment and stock valuation. A negative outlook from investors, based on concerns about any of these risks, could lead to a decline in the stock price, even if the company’s fundamental performance remains relatively strong.

Helpful Answers

What is the current Costco stock price?

The current Costco stock price fluctuates constantly and can be found on major financial websites like Google Finance, Yahoo Finance, or Bloomberg.

How often does Costco pay dividends?

Costco typically pays dividends quarterly.

Where can I buy Costco stock?

Costco stock can be purchased through most online brokerage accounts.

Is Costco stock a good long-term investment?

Whether Costco stock is a good long-term investment depends on individual risk tolerance and investment goals. Consider conducting thorough research and possibly consulting a financial advisor before making any investment decisions.