Factors Influencing Car Stock Prices

Car stock price – The automotive industry is a complex ecosystem influenced by a multitude of factors, both internal and external, which directly impact the performance of car company stocks. Understanding these factors is crucial for investors seeking to navigate this dynamic market.

Macroeconomic Indicators and Car Stock Prices

Broad economic trends significantly influence the automotive sector. High interest rates, for example, increase borrowing costs for consumers, reducing demand for new vehicles and consequently impacting car manufacturers’ profitability and stock prices. Conversely, periods of low interest rates can stimulate consumer spending, boosting sales and positively affecting stock valuations. Inflation affects raw material costs, impacting production expenses and profit margins.

Strong GDP growth generally translates to increased consumer spending and higher demand for cars, leading to improved stock performance, while economic slowdowns can have the opposite effect.

Industry-Specific Factors

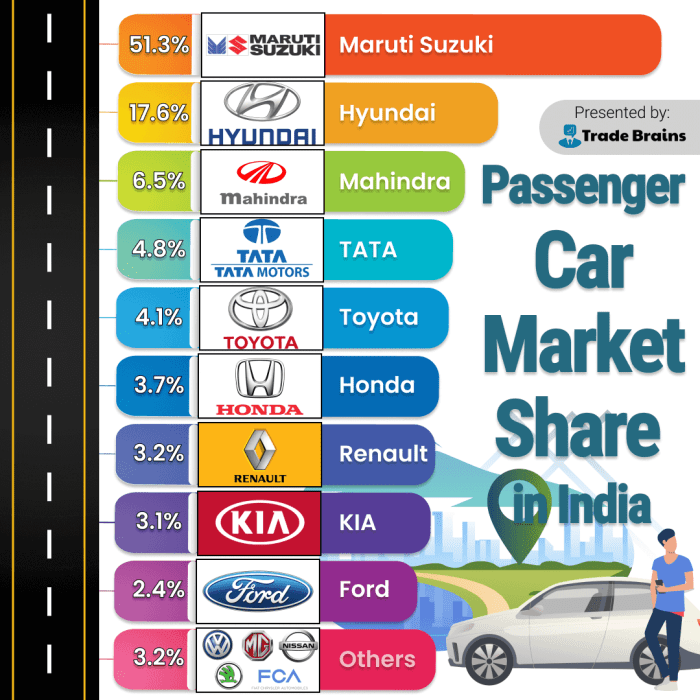

Source: tradebrains.in

Within the automotive industry, several specific factors influence stock prices. Supply chain disruptions, such as those experienced during the pandemic, can severely limit production and negatively impact profitability. Fluctuations in raw material costs, particularly steel and aluminum, directly affect manufacturing expenses and can significantly influence a company’s bottom line. Technological advancements, like the rise of electric vehicles, can reshape the industry landscape, creating opportunities for some companies while posing challenges to others.

The successful integration of new technologies often correlates with positive stock performance, while companies slow to adapt may see their valuations suffer.

Consumer Sentiment and Purchasing Power

Consumer confidence and purchasing power are key drivers of car sales. Positive consumer sentiment translates to higher demand, while economic uncertainty and reduced purchasing power can lead to decreased sales. The relationship between consumer confidence indices and car stock performance is generally positive; strong consumer confidence tends to lead to higher stock valuations, and vice versa.

Monitoring car stock prices can be a complex endeavor, influenced by various economic factors and industry trends. However, understanding the broader market is crucial; for example, consider the performance of technology giants like Sony, whose stock price often reflects investor sentiment. You can check the current sony company stock price to get a sense of overall market health, which can then inform your assessment of car manufacturer stock values.

Ultimately, car stock price fluctuations are often interconnected with the wider economic landscape.

Government Regulations and Automotive Stocks

Government regulations play a significant role in shaping the automotive industry. Stringent emissions standards, for instance, can increase manufacturing costs and necessitate significant investments in research and development for cleaner technologies. While these regulations can benefit environmentally conscious consumers and contribute to long-term sustainability, the short-term impact on stock prices can be negative due to increased costs. Similarly, changes in safety regulations can impact design and production, influencing both costs and consumer appeal, subsequently affecting stock valuations.

Comparative Stock Performance of Major Car Manufacturers

The following table compares the stock performance of three major car manufacturers over the past five years. Note that these figures are illustrative and may vary depending on the specific timeframe and data source used.

| Company | 2019 | 2020 | 2021 | 2022 | Key Events |

|---|---|---|---|---|---|

| Toyota | +10% | -5% | +25% | +15% | Supply chain challenges, strong hybrid sales |

| Ford | -12% | -30% | +50% | -10% | Pandemic impact, chip shortage, EV investments |

| General Motors | +5% | -20% | +30% | +5% | Recall issues, EV transition, strong truck sales |

Analyzing Specific Car Company Stock Performance

Understanding the individual factors affecting specific car manufacturers is crucial for informed investment decisions. This section delves into the recent performance of Tesla and Ford, highlighting key contributing factors.

Tesla Stock Price Performance

Tesla’s stock price has experienced significant volatility, driven by a combination of factors. High demand for its electric vehicles, coupled with innovative technology and strong brand recognition, has fueled substantial price increases. However, production challenges, supply chain issues, and CEO pronouncements have at times resulted in sharp price corrections. Overall, Tesla’s performance reflects the high-growth, high-risk nature of the electric vehicle market.

Ford Motor Company Stock Price Fluctuations

Ford’s stock price has been influenced by its transition towards electric vehicles, its performance in the traditional internal combustion engine market, and global economic conditions. The company’s investments in electric vehicle technology have been met with a mixed reception, while its continued reliance on traditional vehicles makes it vulnerable to fluctuations in fuel prices and consumer preferences. Ford’s stock price also reflects the broader economic climate and its impact on consumer spending.

Investor Strategies in the Automotive Sector, Car stock price

Investors in the automotive sector employ diverse strategies, ranging from long-term value investing to short-term trading. Value investors focus on companies with undervalued assets and strong fundamentals, seeking long-term growth. Growth investors target companies with high growth potential, often in emerging sectors like electric vehicles. Short-term traders may focus on technical analysis to identify short-term price movements, seeking quick profits.

These diverse approaches reflect the varied risk tolerances and investment horizons of different investors.

Major Risks Associated with Investing in Car Stocks

Investing in car stocks carries inherent risks. Economic downturns can significantly reduce demand for vehicles, impacting profitability. Technological disruptions can render existing technologies obsolete, potentially leading to significant losses. Geopolitical instability and supply chain disruptions can also negatively impact production and sales. Mitigation strategies include diversification across different car manufacturers and geographic regions, thorough due diligence, and a well-defined investment strategy.

Future Trends Impacting Car Stock Prices

- The continued growth of electric vehicles and the related infrastructure development will significantly impact the valuations of both traditional and electric vehicle manufacturers.

- Advancements in autonomous driving technology will reshape the automotive industry, potentially leading to consolidation and significant shifts in market share.

- The increasing focus on sustainability and the adoption of stricter environmental regulations will necessitate significant investments in research and development, impacting profitability and stock prices.

Investment Strategies Related to Car Stocks: Car Stock Price

Successful investment in the automotive sector requires a well-defined strategy incorporating fundamental and technical analysis, diversification, and a thorough understanding of market trends.

Automotive Stock Portfolio Design

A diversified portfolio should include a mix of established car manufacturers with a proven track record and emerging players in the electric vehicle and autonomous driving sectors. This approach helps to balance risk and reward, capitalizing on both established and emerging opportunities.

Fundamental Analysis of Car Company Stocks

Fundamental analysis involves evaluating a company’s intrinsic value by examining its financial statements, business model, competitive landscape, and management team. Investors use metrics such as price-to-earnings ratio (P/E), return on equity (ROE), and debt-to-equity ratio to assess the company’s financial health and growth potential. This approach helps identify undervalued companies with strong growth prospects.

Technical Analysis for Car Stock Trading

Technical analysis uses charts and other technical indicators to identify potential buying and selling opportunities. Investors look for patterns in price movements, trading volume, and other technical indicators to predict future price trends. This approach is particularly useful for short-term traders seeking to capitalize on short-term price fluctuations.

Diversification within the Automotive Sector

Diversification can be achieved by investing in car manufacturers from different geographic regions and specializing in different vehicle types (e.g., passenger cars, trucks, SUVs). This reduces risk by spreading investments across various market segments and mitigating the impact of localized economic downturns or specific market trends.

Resources for Tracking Car Stock Prices

- Financial news websites (e.g., Yahoo Finance, Google Finance, Bloomberg)

- Brokerage platforms (e.g., TD Ameritrade, Fidelity, Schwab)

- Analyst reports from investment banks and research firms

- Company investor relations websites

Illustrative Examples of Stock Price Movements

Several real-world examples highlight how various events can significantly impact car stock prices.

Technological Breakthrough Impact

The introduction of Tesla’s Autopilot system, an early example of advanced driver-assistance systems, initially led to a surge in Tesla’s stock price as investors recognized the potential of autonomous driving technology. However, subsequent accidents and regulatory scrutiny resulted in some price corrections, demonstrating the volatile nature of the market response to technological advancements.

Major Recall Impact

The Takata airbag recall, one of the largest automotive recalls in history, resulted in a significant drop in the stock prices of several car manufacturers that used Takata airbags. The recall’s impact on reputation, financial costs, and production disruptions contributed to the negative stock performance. This illustrates the severe impact of safety-related issues on investor confidence.

Shift in Consumer Preferences

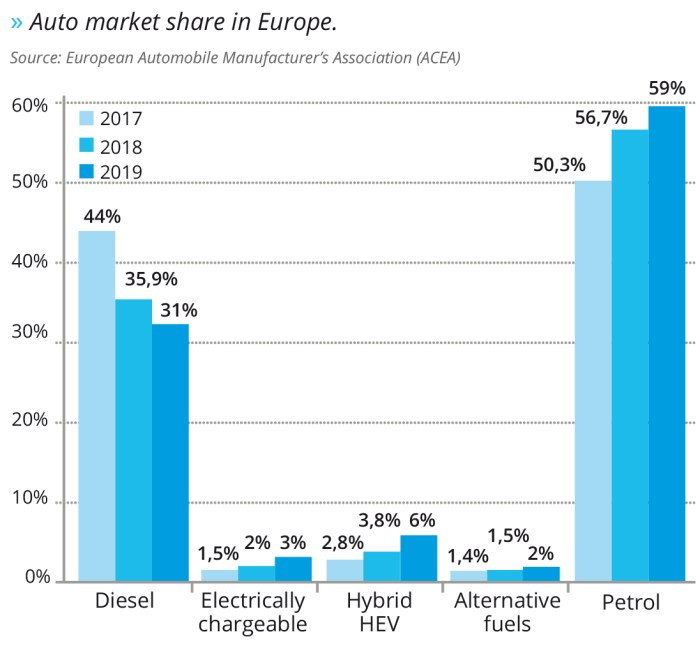

Source: vpsolar.com

The shift in consumer preferences towards SUVs and crossovers in recent years has benefited SUV manufacturers, while impacting the valuations of companies primarily focused on sedans. This exemplifies how changing consumer tastes can significantly influence market share and stock prices.

Geopolitical Events Impact

Geopolitical events, such as trade wars and sanctions, can significantly affect the global automotive industry. For example, trade disputes between the US and China have led to uncertainty and volatility in the stock prices of car manufacturers with significant operations in both countries. This underscores the importance of considering geopolitical risks when investing in globally operating car companies.

FAQ Resource

What are the best resources for tracking car stock prices?

Major financial news websites like Yahoo Finance, Google Finance, and Bloomberg provide real-time stock quotes and historical data. Many brokerage platforms also offer comprehensive charting tools and research reports.

How can I mitigate the risk of investing in car stocks?

Diversify your portfolio across different car manufacturers and geographic regions. Conduct thorough fundamental and technical analysis before investing, and only invest what you can afford to lose. Stay informed about industry news and potential risks.

What is the impact of inflation on car stock prices?

High inflation can negatively impact car stock prices due to increased production costs and reduced consumer spending. Conversely, moderate inflation can sometimes stimulate economic activity and benefit the sector.

How do government subsidies for electric vehicles affect car stock prices?

Government subsidies for EVs can significantly boost the stock prices of companies heavily invested in electric vehicle technology, as it increases demand and profitability.