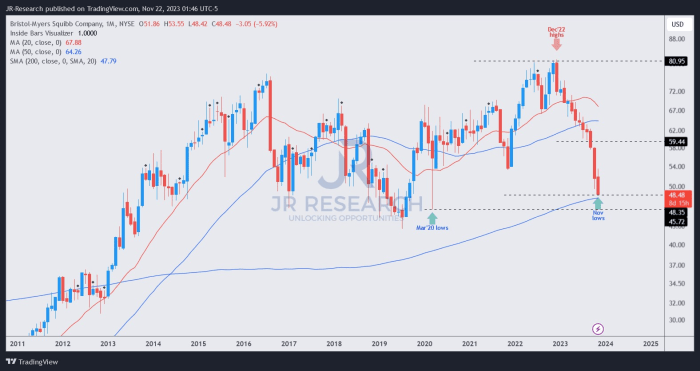

Bristol Myers Squibb Stock Price Analysis

Bristol myers squibb stock price – Bristol Myers Squibb (BMS) is a prominent pharmaceutical company with a rich history and a significant presence in the global healthcare market. This analysis delves into various aspects of BMS, examining its historical performance, current financial standing, and future prospects to provide insights into its stock price fluctuations and investment potential.

Bristol Myers Squibb Company Overview

Understanding BMS’s core business is crucial for assessing its stock performance. This section provides a concise overview of the company’s history, therapeutic areas, key products, and revenue streams.

| History | Therapeutic Areas | Key Products | Revenue Streams |

|---|---|---|---|

| Founded through mergers and acquisitions, BMS boasts a long history of pharmaceutical innovation and development, evolving from its origins to become a global leader. | Oncology, Cardiovascular, Immunology, and Hematology are major therapeutic areas for BMS, reflecting a diversified approach to drug development. | Opdivo (nivolumab), Revlimid (lenalidomide), and Eliquis (apixaban) are among BMS’s top-selling drugs, contributing significantly to its revenue. | Prescription drug sales constitute the primary revenue source, complemented by royalties and licensing agreements. Geographical diversification across various markets also contributes to revenue streams. |

Factors Influencing Stock Price, Bristol myers squibb stock price

Several factors significantly influence BMS’s stock price. This section highlights macroeconomic conditions, competitor activity, and regulatory changes, providing a comprehensive perspective on the dynamics affecting its valuation.

- Macroeconomic Factors: Interest rate changes, inflation rates, and overall economic growth significantly impact investor sentiment and consequently, BMS’s stock price. For example, rising interest rates can make investments in growth stocks, like pharmaceutical companies, less attractive.

- Competitor Activity: The intense competition within the pharmaceutical industry, with companies constantly developing and launching new drugs, directly influences BMS’s market share and profitability, impacting its stock valuation. Successful launches by competitors can erode BMS’s market position.

- Regulatory Changes: Changes in drug pricing policies, approval processes, and patent expirations can have a substantial impact on BMS’s revenue and profitability, consequently influencing investor confidence and stock price.

Clinical trial results significantly impact the stock price.

- Positive Clinical Trial Results: Lead to increased investor confidence, potentially driving stock price appreciation. Successful trials validate the efficacy and safety of new drugs, paving the way for market expansion and increased revenue.

- Negative Clinical Trial Results: Can lead to a decline in investor confidence and a drop in the stock price. Negative results might halt further development, reducing potential revenue streams and impacting the company’s overall outlook.

Financial Performance Analysis

Source: investorplace.com

Analyzing BMS’s financial performance over the past five years offers valuable insights into its growth trajectory and profitability. This section details key financial ratios and metrics relevant to stock valuation.

Over the past five years, BMS has demonstrated [Insert general trend – e.g., consistent revenue growth, fluctuating profitability, etc.]. Key financial ratios such as Return on Equity (ROE), Return on Assets (ROA), and Debt-to-Equity ratio will be analyzed to provide a holistic picture of financial health. A detailed breakdown of revenue, expenses, and net income will be provided, highlighting significant trends and variations.

Earnings Per Share (EPS) Trend: A text-based illustration of the EPS trend over the past five years would show [Insert descriptive trend, e.g., a gradual upward trend, periods of growth followed by decline, etc.]. This visual representation will highlight the correlation between earnings and the stock price.

Research and development (R&D) spending is a significant factor influencing long-term stock performance. Higher R&D spending indicates a commitment to innovation and future growth potential, but it also impacts short-term profitability. A balanced approach, where R&D investments lead to successful drug launches, is crucial for positive stock performance.

Investment Considerations

Source: seekingalpha.com

Before investing in BMS stock, a comparative analysis against competitors and a thorough assessment of potential risks and catalysts are essential. This section explores these aspects, along with potential investment strategies.

BMS’s valuation is compared to its competitors [e.g., Pfizer, Johnson & Johnson] using metrics such as Price-to-Earnings (P/E) ratio and Market Capitalization. This comparison provides a relative valuation perspective, considering market positioning and growth potential.

Potential risks associated with investing in BMS stock include: competition, regulatory hurdles, patent expirations, and fluctuations in the global healthcare market. These factors can negatively impact revenue and profitability, affecting stock valuation.

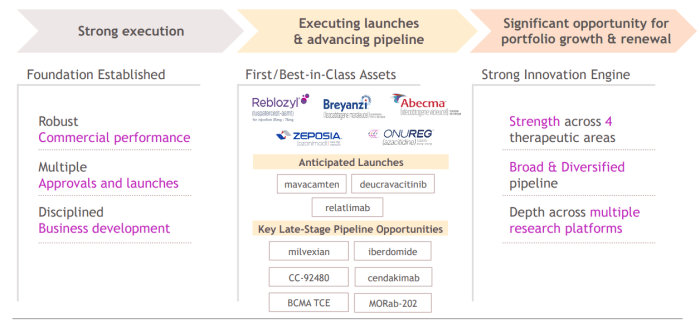

Potential catalysts for future stock price appreciation include: successful clinical trials, new drug approvals, expansion into new markets, and strategic acquisitions. These events can enhance the company’s revenue streams and overall growth potential.

| Risk Tolerance | Investment Strategy | Expected Return/Risk |

|---|---|---|

| Low | Long-term buy-and-hold strategy with diversification across other sectors. | Moderate return, low risk. |

| Medium | Combination of long-term and short-term strategies, leveraging market fluctuations. | Moderate to high return, moderate risk. |

| High | Aggressive trading strategy focused on short-term gains based on market analysis and news events. | High return, high risk. |

Future Outlook and Predictions

Source: seekingalpha.com

Bristol Myers Squibb’s stock price performance often draws comparisons to other pharmaceutical and luxury giants. It’s interesting to consider how its trajectory contrasts with the performance of luxury goods conglomerates, such as LVMH, whose stock price you can check here: lvmh stock price. Ultimately, understanding Bristol Myers Squibb’s valuation requires a separate analysis of its pipeline and market position, independent of LVMH’s success.

BMS’s future prospects depend heavily on its drug pipeline and long-term growth strategy. This section explores these aspects, along with a hypothetical scenario illustrating a positive impact on the stock price.

BMS’s pipeline of new drugs [mention specific examples if available] holds significant potential for market expansion and revenue growth. The success of these drugs will heavily influence the company’s future profitability and stock valuation. Long-term growth prospects are positive, considering the increasing demand for innovative treatments in various therapeutic areas.

Hypothetical Positive Scenario: A successful Phase 3 clinical trial for a novel cancer therapy could significantly boost investor confidence, leading to a surge in the stock price. This positive outcome would demonstrate the efficacy and market potential of the new drug, attracting significant investment and potentially driving a substantial increase in market capitalization.

Hypothetical Press Release:

FOR IMMEDIATE RELEASE

Bristol Myers Squibb Announces FDA Approval of Novel Cancer Therapy, “OncoBreakthrough”

[City, State] – [Date] – Bristol Myers Squibb (BMS) today announced that the U.S. Food and Drug Administration (FDA) has approved OncoBreakthrough™, a groundbreaking new therapy for [Specific Cancer Type]. This approval marks a significant milestone in the fight against [Specific Cancer Type] and represents a major advancement in cancer treatment. OncoBreakthrough™ demonstrated superior efficacy and safety compared to existing treatments in clinical trials.

BMS is committed to making OncoBreakthrough™ available to patients as quickly as possible.

Detailed FAQs

What is Bristol Myers Squibb’s dividend yield?

The dividend yield fluctuates and should be checked on a financial website for the most up-to-date information.

How does BMS compare to other large pharmaceutical companies?

A comparative analysis considering market capitalization, revenue, and profit margins against competitors like Pfizer and Merck is necessary to draw meaningful conclusions.

What are the major risks associated with investing in BMS?

Key risks include patent expirations, clinical trial failures, regulatory changes, and general market volatility.

Where can I find real-time BMS stock price information?

Major financial websites (e.g., Yahoo Finance, Google Finance) provide real-time stock quotes and charting tools.