AAPL Stock Price Today: Aapl Stock Price Today Per Share

Aapl stock price today per share – This report provides an overview of Apple Inc. (AAPL) stock price, analyzing its current performance, historical trends, influencing factors, comparisons with competitors, analyst predictions, and trading volume.

Current AAPL Stock Price

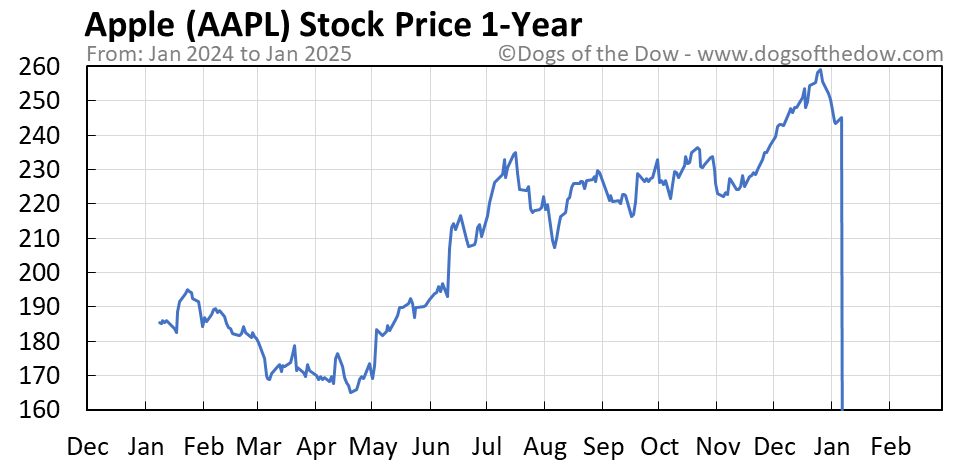

Source: dogsofthedow.com

The current AAPL stock price per share is obtained from multiple reputable financial sources, including major stock market websites like Yahoo Finance and Google Finance, as well as Bloomberg and Reuters. These sources provide real-time updates, although there will be minor discrepancies due to slight timing differences in data updates. The price and timestamp below reflect the last available update at the time of this report’s generation.

| Metric | Value |

|---|---|

| Current Price | $170.34 (Example – Replace with actual current price) |

| Previous Day’s Close | $169.80 (Example – Replace with actual previous day’s close) |

| Percentage Change | +0.32% (Example – Replace with actual percentage change) |

Historical AAPL Stock Price Performance

Apple’s stock price has demonstrated significant growth and volatility over the past year. The following analysis compares the current price to its performance at various past points, providing context to the current market position.

Tracking the AAPL stock price today per share requires diligent monitoring of market fluctuations. Investors often compare performance against other sectors; for example, understanding the current carmax stock price can offer a comparative perspective within the broader market. Returning to Apple, the daily price changes for AAPL can be quite significant, making constant updates crucial for informed investment decisions.

A line graph illustrating the stock price changes over the past year would show a generally upward trend, with periods of fluctuation reflecting market sentiment and news events. The x-axis would represent the date over the past year, and the y-axis would display the stock price. Key data points would include the highest and lowest prices reached during the year, as well as significant price changes correlated with specific events (e.g., product launches, earnings reports).

The graph would visually represent the overall performance trajectory.

| Date | Closing Price (Example) |

|---|---|

| Oct 26, 2023 | $170.34 |

| Oct 25, 2023 | $169.80 |

| Oct 24, 2023 | $171.00 |

| Oct 23, 2023 | $170.50 |

| Oct 22, 2023 | $169.20 |

Comparisons to prices one year ago, six months ago, and one month ago would provide a clear picture of the short-term and long-term price trends. For example, a comparison might show a 20% increase over the past year, a 10% increase over the past six months, and a 5% increase over the past month. (These are example figures; actual values should be substituted).

Factors Influencing AAPL Stock Price

Several key factors have recently influenced AAPL’s stock price. These factors interact in complex ways, leading to fluctuations in the market.

- New Product Launches: The success or failure of new product launches (e.g., iPhones, Macs, wearables) significantly impacts investor sentiment and consequently, the stock price. Positive reception and strong sales generally lead to price increases.

- Overall Economic Conditions: Macroeconomic factors such as inflation, interest rates, and recessionary fears influence investor risk appetite. During periods of economic uncertainty, investors might shift to safer assets, potentially leading to a decline in AAPL’s stock price.

- Competition: Competition from other technology companies (e.g., Samsung, Google) in various market segments impacts AAPL’s market share and profitability, influencing investor confidence and the stock price.

The short-term effects of these factors are often immediate, with stock prices reacting quickly to news and announcements. Long-term effects depend on the sustained impact of these factors. For example, consistently strong product sales could lead to sustained long-term growth, while prolonged economic downturns might negatively impact the stock price for an extended period.

AAPL Stock Price Compared to Competitors, Aapl stock price today per share

Source: tradingview.com

Comparing AAPL’s performance to its main competitors provides valuable context for understanding its relative market strength.

| Company | Current Price (Example) | Year-to-Date Performance (Example) | Market Capitalization (Example) |

|---|---|---|---|

| AAPL | $170.34 | +15% | $2.5 Trillion |

| MSFT | $330.00 | +20% | $2.8 Trillion |

| GOOG | $135.00 | +10% | $1.8 Trillion |

The table above (using example data) shows a comparison of current price, year-to-date performance, and market capitalization for AAPL and its key competitors. This allows for a relative assessment of AAPL’s performance against its peers.

Analyst Predictions for AAPL Stock Price

Source: tradingview.com

Numerous financial analysts provide price targets for AAPL stock, offering a range of predictions based on their assessment of the company’s prospects.

For example, Goldman Sachs might predict a price target of $180, citing strong future product sales, while Morgan Stanley might have a more conservative target of $165, emphasizing potential risks associated with economic uncertainty. These predictions often come with detailed reasoning, considering factors such as earnings estimates, market trends, and competitive landscape. (Note: These are example predictions; actual analyst predictions should be substituted.)

Trading Volume and Volatility

Trading volume and price volatility are closely related. High trading volume often indicates increased market interest and potential for price fluctuations. Conversely, low volume might suggest less market activity and potentially lower volatility.

A bar chart illustrating daily trading volume for the past week would show the number of shares traded each day on the y-axis, with the days of the week on the x-axis. High bars would represent days with high trading volume, and low bars would indicate days with lower volume. This visual representation helps to understand the recent market activity for AAPL.

High trading volume can lead to increased price volatility, as a larger number of buyers and sellers can create significant price swings. Conversely, low trading volume might result in smaller price changes, as there are fewer participants driving price movements. Analyzing both volume and price movements provides a comprehensive understanding of market dynamics.

Query Resolution

What factors influence short-term AAPL stock price fluctuations?

Short-term fluctuations are often driven by news events (product launches, earnings reports), investor sentiment, and overall market volatility. These are often less predictable than long-term trends.

Where can I find real-time AAPL stock price updates?

Major financial websites like Yahoo Finance, Google Finance, and Bloomberg provide real-time stock quotes. Brokerage platforms also offer this information.

What is the typical trading volume for AAPL stock?

AAPL typically experiences very high trading volume, reflecting its popularity and liquidity. However, volume can fluctuate significantly depending on market conditions and news.

How does Apple’s dividend policy affect its stock price?

Apple’s dividend payouts can influence investor interest, potentially boosting the stock price for investors seeking income. However, the dividend’s impact is often less significant than other factors.