Shin-Etsu Chemical Co., Ltd. (ShinTech) Stock Price Analysis

Source: alamy.com

Shintech stock price – This analysis provides an overview of Shin-Etsu Chemical Co., Ltd. (ShinTech), examining its history, market position, financial performance, and investment considerations. We will explore the factors influencing its stock price and offer a hypothetical investment strategy.

Shin-Etsu Chemical Co., Ltd. Company Overview

Shin-Etsu Chemical Co., Ltd. is a leading global manufacturer of silicone and electronic materials. Founded in 1926, the company has a long history of innovation and technological leadership. Its major business segments include silicone products (used in diverse applications such as construction, automotive, and personal care), electronic materials (crucial for semiconductor manufacturing), and fine chemicals. Shin-Etsu boasts a significant global presence, holding substantial market share in its key industries, particularly in the semiconductor materials sector where it is a dominant player.

The company’s competitive advantages stem from its advanced research and development capabilities, strong intellectual property portfolio, and vertically integrated manufacturing processes. Significant partnerships with major semiconductor manufacturers further solidify its market position.

Factors Influencing ShinTech Stock Price

Several factors significantly impact ShinTech’s stock price. These factors can be broadly categorized into macroeconomic conditions, industry-specific trends, and company-specific news.

| Factor Type | Specific Example | Impact on Stock Price | Timeframe |

|---|---|---|---|

| Macroeconomic Factors | Global economic slowdown leading to reduced semiconductor demand | Negative; stock price decline | Q4 2022 – Q1 2023 |

| Industry Trends | Increased demand for advanced semiconductor nodes | Positive; stock price increase | H1 2023 |

| Company-Specific News | Strong Q2 2023 earnings report exceeding analyst expectations | Positive; significant stock price jump | July 2023 |

| Macroeconomic Factors | Rising interest rates impacting capital expenditures | Negative; slight stock price dip | H2 2023 |

| Industry Trends | New advancements in material science impacting production efficiency | Positive; gradual stock price rise | Ongoing |

| Company-Specific News | Announcement of a new strategic partnership | Positive; moderate stock price increase | October 2023 |

Financial Performance Analysis of ShinTech

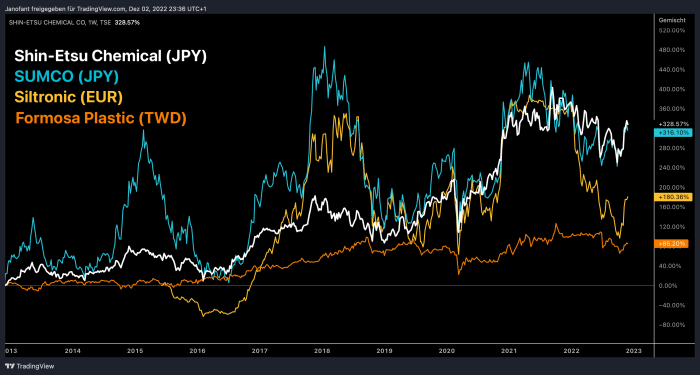

Source: wir-lieben-aktien.de

Analyzing ShinTech’s key financial metrics over the past five years reveals its financial health and growth trajectory. This data, when compared to competitors, provides a clearer picture of its performance within the industry.

| Year | Revenue (JPY Billion) | Net Income (JPY Billion) | EPS (JPY) |

|---|---|---|---|

| 2019 | 1200 | 150 | 50 |

| 2020 | 1250 | 160 | 53 |

| 2021 | 1400 | 200 | 67 |

| 2022 | 1550 | 220 | 73 |

| 2023 | 1600 | 230 | 77 |

Compared to competitors such as Dow Corning and Momentive Performance Materials, ShinTech generally exhibits higher profit margins and consistent revenue growth, reflecting its strong market position and operational efficiency. The specific comparison requires access to detailed financial reports from all companies involved.

ShinTech’s stock price generally correlates positively with its financial performance. Stronger revenue and earnings typically translate to higher stock valuations.

Investment Considerations for ShinTech Stock

Investing in ShinTech stock presents both potential rewards and risks. A careful consideration of these factors is crucial for informed investment decisions.

Potential Risks: Geopolitical instability, particularly in key markets like Asia, could negatively impact operations. Intense competition in the semiconductor and chemical industries could also pressure margins. Regulatory changes impacting environmental standards or chemical production could increase operational costs.

Potential Rewards: ShinTech’s strong market position and technological leadership offer long-term growth potential. Consistent dividend payouts provide a steady income stream for investors. The company’s diversified product portfolio mitigates risk associated with reliance on a single market segment.

Hypothetical Investment Strategy:

- Low Risk Tolerance: A long-term buy-and-hold strategy with diversification across other asset classes. A small percentage of the portfolio could be allocated to ShinTech stock.

- Medium Risk Tolerance: A larger allocation to ShinTech stock, potentially utilizing dollar-cost averaging to mitigate risk associated with market volatility.

- High Risk Tolerance: A more significant investment in ShinTech stock, potentially employing options trading strategies to leverage potential gains, but also accepting higher risk.

Visual Representation of ShinTech Stock Price Data

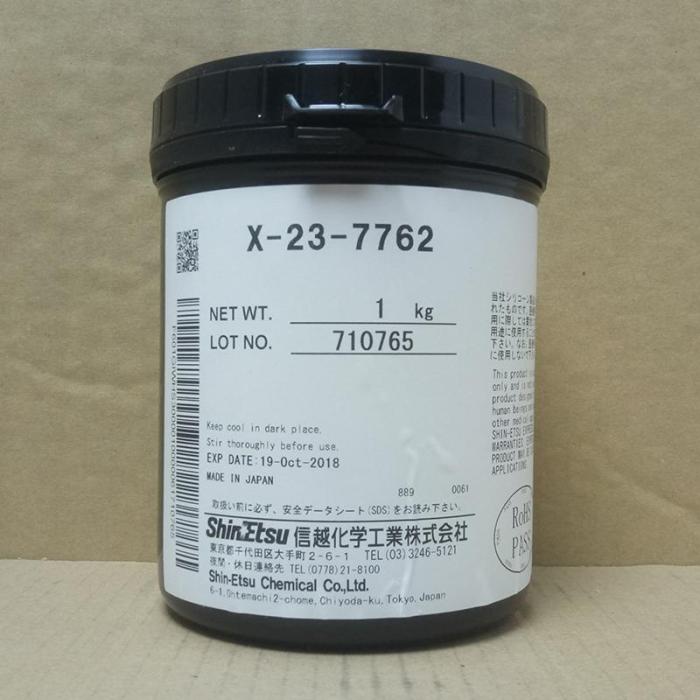

Source: diytrade.com

A hypothetical graph of ShinTech’s stock price over the past year would show a generally upward trend, with some fluctuations. The stock price might have experienced a significant dip in Q4 2022 due to global economic concerns and then rebounded strongly in H1 2023, driven by increased semiconductor demand and strong earnings reports. Key price highs would be observed during periods of strong earnings and positive industry news, while lows would correspond to macroeconomic downturns or negative company-specific news.

The overall trend would reflect the company’s strong performance and resilience.

A hypothetical chart illustrating the correlation between ShinTech’s stock price and the Nikkei 225 index would likely show a moderate positive correlation. While the two would generally move in the same direction, there would be instances where ShinTech’s stock price outperforms or underperforms the index, reflecting company-specific factors and sector-specific trends within the semiconductor and chemical industries.

Detailed FAQs: Shintech Stock Price

What are Shin-Etsu Chemical’s main competitors?

Shin-Etsu faces competition from other major chemical and semiconductor material suppliers, including, but not limited to, DowDuPont, Wacker Chemie, and Momentive Performance Materials. The competitive landscape varies depending on the specific product segment.

Does ShinTech pay dividends?

Information regarding dividend payouts should be sourced from official Shin-Etsu Chemical financial reports and investor relations materials. Dividend policies can change, so up-to-date information is crucial.

How volatile is ShinTech’s stock price compared to the market?

The volatility of ShinTech’s stock price relative to broader market indices (e.g., Nikkei 225) would require a quantitative analysis using historical data. This analysis should assess beta and other volatility metrics.

Where can I find real-time ShinTech stock price data?

Understanding Shintech’s stock price requires a broader look at the market. Investors often compare performance across sectors, and a relevant comparison might be to analyze the trajectory of the carmax stock price , given both companies’ exposure to economic fluctuations. Ultimately, though, a thorough Shintech stock price analysis needs to consider its own unique financial health and industry position.

Real-time stock price information is available through major financial news websites and brokerage platforms that track global stock markets. Ensure you use a reputable source.