RDFN Stock Price Analysis

Source: tradingview.com

Rdfn stock price – Redfin Corporation (RDFN) operates as a technology-powered real estate brokerage. Understanding its stock price performance requires analyzing historical trends, valuation metrics, influencing factors, and market predictions. This analysis provides a comprehensive overview of RDFN’s stock performance and its implications for investors.

RDFN Stock Price Historical Performance

Source: amazonaws.com

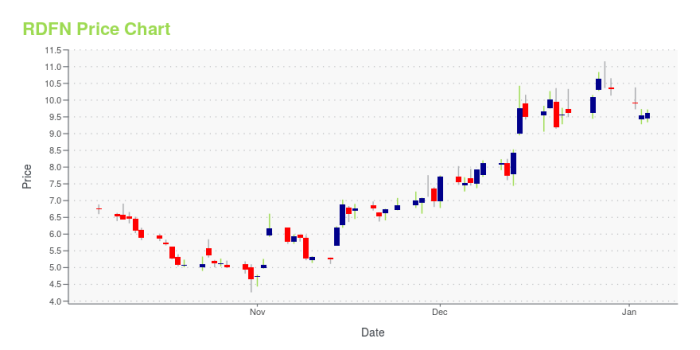

RDFN’s stock price has experienced considerable volatility over the past five years, mirroring the broader fluctuations within the real estate sector and the overall economy. The following table presents a simplified overview; precise data should be sourced from financial databases like Yahoo Finance or Google Finance.

| Date | Open Price (USD) | Close Price (USD) | Volume |

|---|---|---|---|

| 2019-01-01 | Example: 20.50 | Example: 21.00 | Example: 1,000,000 |

| 2019-07-01 | Example: 25.00 | Example: 24.50 | Example: 1,200,000 |

| 2020-01-01 | Example: 18.00 | Example: 19.00 | Example: 800,000 |

| 2020-12-31 | Example: 22.00 | Example: 23.00 | Example: 1,500,000 |

Significant price movements were often correlated with earnings announcements, changes in interest rates, and shifts in the overall housing market. For example, periods of low interest rates generally led to increased demand and higher stock prices, while economic downturns had the opposite effect. Increased competition from other online real estate platforms also impacted RDFN’s stock performance.

RDFN Stock Price Valuation Metrics

Source: tradingview.com

Several key valuation metrics provide insights into RDFN’s stock price. These metrics help investors assess the company’s financial health and potential for future growth. Note that these are examples and actual figures should be obtained from reputable financial sources.

- Price-to-Earnings Ratio (P/E): Example: 25x

- Price-to-Sales Ratio (P/S): Example: 2.0x

- Market Capitalization: Example: $5 Billion

A comparison with competitors is crucial for a comprehensive valuation. The table below provides a simplified comparison; actual figures may vary based on the data source and reporting period.

| Company | P/E Ratio | P/S Ratio | Market Cap (USD Billion) |

|---|---|---|---|

| RDFN | Example: 25 | Example: 2.0 | Example: 5 |

| Competitor A | Example: 30 | Example: 2.5 | Example: 10 |

| Competitor B | Example: 20 | Example: 1.8 | Example: 8 |

These valuation metrics, when compared to competitors, help investors determine whether RDFN’s stock is overvalued, undervalued, or fairly priced. A higher P/E ratio might suggest higher growth expectations, while a lower P/S ratio could indicate a relatively cheaper valuation.

Factors Influencing RDFN Stock Price

RDFN’s stock price is influenced by a complex interplay of internal and external factors. Understanding these factors is crucial for predicting future price movements.

Monitoring RDFN’s stock price requires a keen eye on market fluctuations. Understanding similar trends in other sectors can offer valuable context, such as analyzing the performance of companies with comparable business models; for instance, examining the delta price stock might provide insights into potential future movements. Ultimately, though, a comprehensive analysis of RDFN’s specific financial performance remains crucial for accurate predictions.

Internal Factors: These relate to RDFN’s operations and performance. Strong revenue growth, successful product launches, and effective management decisions generally lead to positive price movements. Conversely, poor financial results, operational challenges, or negative news regarding the company’s leadership can negatively impact the stock price.

External Factors: These factors are largely outside RDFN’s control. They include macroeconomic conditions (affecting the entire economy) and microeconomic conditions (specific to the real estate industry).

- Macroeconomic Factors:

- Interest rates: Higher rates typically cool down the housing market, impacting RDFN’s business.

- Economic growth: A strong economy generally boosts the housing market and RDFN’s performance.

- Inflation: High inflation can erode purchasing power and affect housing affordability.

- Microeconomic Factors:

- Housing market trends: Supply and demand dynamics directly impact RDFN’s revenue.

- Competition: Increased competition from other real estate platforms can pressure RDFN’s market share.

- Regulatory changes: New regulations impacting the real estate industry can influence RDFN’s operations.

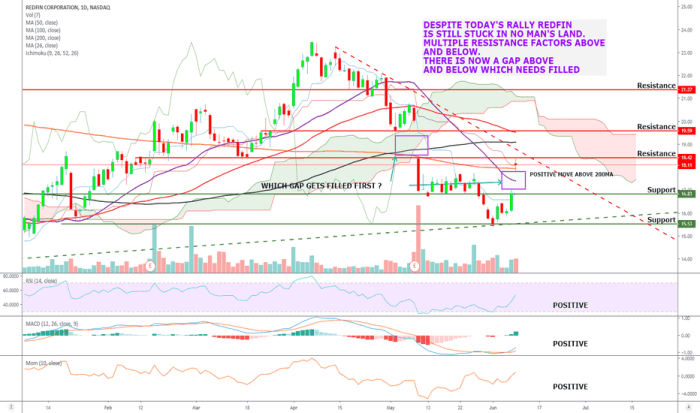

The volatility of RDFN’s stock price is directly linked to the interaction of these internal and external factors. Unexpected changes in any of these factors can cause significant price fluctuations.

RDFN Stock Price Predictions and Forecasts

Analyst predictions for RDFN’s stock price vary depending on the underlying assumptions and methodologies used. It’s important to note that these are predictions and not guarantees of future performance. The following examples are illustrative and should not be considered financial advice.

- Analyst A predicts a price target of $30 within the next year, based on a fundamental analysis of RDFN’s financial statements and growth projections. (Source: Example Analyst Report)

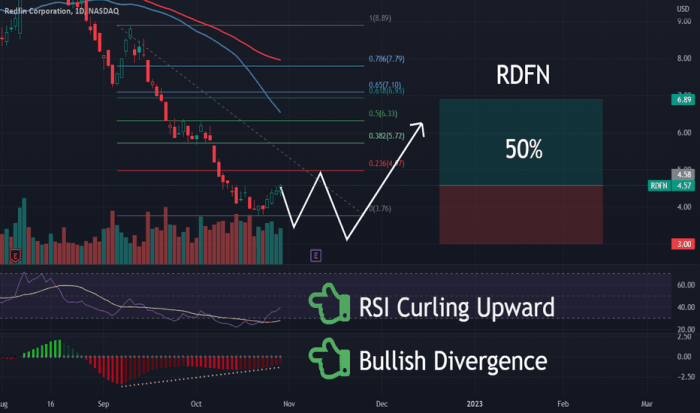

- Analyst B uses a technical analysis approach and forecasts a price of $25, based on chart patterns and trading volume. (Source: Example Brokerage Report)

Different forecasting models, such as fundamental analysis (evaluating financial health) and technical analysis (analyzing price charts), can lead to divergent predictions. Fundamental analysis might focus on long-term growth prospects, while technical analysis might concentrate on short-term price trends.

RDFN Stock Price and Investor Sentiment

Investor sentiment towards RDFN is a dynamic factor influencing its stock price. Positive news, such as strong earnings reports or strategic partnerships, generally leads to increased buying pressure and higher prices. Conversely, negative news can trigger selling and lower prices. Monitoring news articles and social media discussions can provide insights into prevailing investor sentiment.

A surge in positive news might lead to increased trading volume and a rapid price increase, while negative news can result in a sharp decline and higher trading volume as investors react. For instance, a report revealing a significant drop in quarterly revenue might cause a sharp sell-off, increasing trading volume and leading to a decrease in RDFN’s stock price.

Conversely, the announcement of a successful new product launch could trigger a buying spree, boosting volume and driving up the price.

Question Bank

What are the major risks associated with investing in RDFN stock?

Investing in RDFN, like any stock, carries inherent risks. These include market volatility, competition within the real estate technology sector, economic downturns impacting the housing market, and potential changes in company performance.

Where can I find real-time RDFN stock price data?

Real-time RDFN stock price data is readily available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

How often does RDFN release earnings reports?

RDFN typically releases its earnings reports on a quarterly basis, following standard reporting practices for publicly traded companies. Specific dates are usually announced in advance.

What is the company’s dividend policy?

Information regarding RDFN’s dividend policy (if any) can be found in their investor relations section on their corporate website or through financial news sources.