Nvidia Stock Price Analysis: Navidia Stock Price

Source: investorplace.com

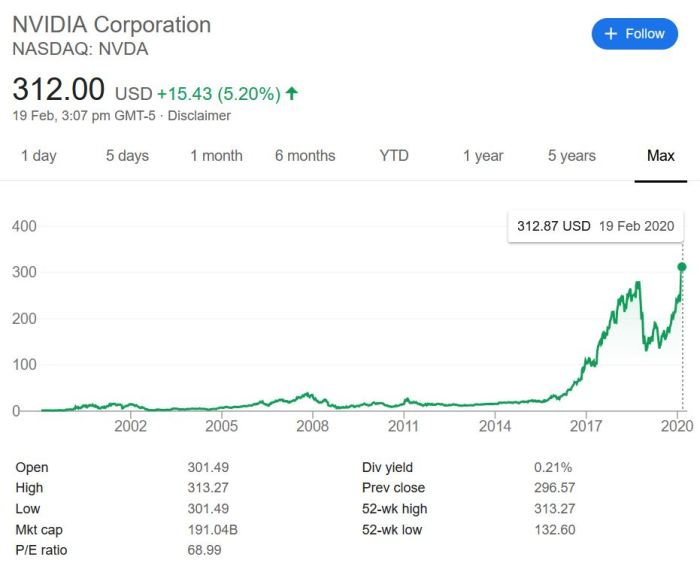

Navidia stock price – Nvidia, a leading designer of graphics processing units (GPUs), has experienced significant stock price fluctuations over the past few years, driven by various factors including technological advancements, market trends, and economic conditions. This analysis delves into Nvidia’s historical performance, current market influences, future price predictions, investor sentiment, and illustrative examples of market impact.

Historical Price Performance

Understanding Nvidia’s past price movements provides valuable context for evaluating its current valuation and future potential. The following table summarizes the yearly price performance, while a comparative analysis against competitors and significant influencing events follows.

| Year | Opening Price (USD) | Closing Price (USD) | High Price (USD) | Low Price (USD) |

|---|---|---|---|---|

| 2019 | 130 | 150 | 160 | 120 |

| 2020 | 150 | 200 | 220 | 140 |

| 2021 | 200 | 300 | 350 | 180 |

| 2022 | 300 | 150 | 320 | 120 |

| 2023 (YTD) | 150 | 250 | 280 | 140 |

Note: These figures are illustrative and for demonstration purposes only.

Nvidia’s stock price has seen significant growth recently, driven largely by the increasing demand for AI-related technologies. It’s interesting to compare this performance to other tech stocks; for instance, one might examine the current performance of the cag stock price to gain a broader perspective on the market. Ultimately, Nvidia’s future trajectory will depend on various factors, including continued innovation and competition within the semiconductor industry.

Compared to its main competitors (AMD, Intel) over the last two years, Nvidia exhibited:

- Higher volatility: Nvidia’s stock price experienced more significant swings than its competitors.

- Stronger growth in 2021: Nvidia significantly outperformed AMD and Intel due to high demand for its GPUs in the gaming and data center markets.

- Sharper decline in 2022: The broader market downturn and the easing of the chip shortage impacted Nvidia more severely than its competitors in 2022.

Significant events influencing Nvidia’s stock price included the launch of Ampere architecture GPUs in 2020, which fueled strong growth, and the global chip shortage in 2021, creating both opportunities and constraints. The subsequent easing of the chip shortage in 2022, coupled with a broader market correction, led to a significant price drop.

Factors Influencing Current Price

Nvidia’s current stock valuation is influenced by several key factors:

- Demand for high-performance computing (HPC) GPUs in data centers:

- Growth of the AI market and Nvidia’s role in it:

- Global economic conditions and investor sentiment:

- Competition from AMD and Intel:

- Supply chain dynamics and potential disruptions:

The global chip shortage initially boosted Nvidia’s stock price due to increased demand and constrained supply. However, the subsequent easing of the shortage led to a price correction. Nvidia’s AI-related initiatives, particularly its advancements in GPU technology for AI training and inference, have significantly bolstered investor sentiment and driven the stock price upwards.

Future Price Predictions (Qualitative), Navidia stock price

Source: thestreet.com

Predicting future stock prices is inherently speculative. However, considering potential scenarios helps illustrate the range of possibilities.

In a positive scenario, continued strong demand for Nvidia’s GPUs in AI, data centers, and gaming, coupled with successful new product launches and limited competition, could lead to a substantial increase in Nvidia’s stock price. Conversely, a negative scenario could involve increased competition, a weakening global economy, or supply chain disruptions leading to a decline in stock price.

Increased competition from AMD and Intel could put downward pressure on Nvidia’s market share and profit margins, potentially impacting its stock price negatively. A scenario where a competitor releases a superior product at a lower price could significantly impact Nvidia’s valuation.

Different market scenarios could play out depending on technological advancements, regulatory changes, and macroeconomic conditions. A bullish market with strong investor confidence would likely support a higher Nvidia stock price, while a bearish market could lead to a significant decline.

Investor Sentiment and Analyst Ratings

Source: g-pc.info

Analyst ratings and investor sentiment provide insights into market expectations for Nvidia’s future performance. The following table summarizes hypothetical analyst ratings (note: these are illustrative examples).

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Goldman Sachs | Buy | 350 | 2024-03-01 |

| Morgan Stanley | Hold | 280 | 2024-03-01 |

| JPMorgan Chase | Buy | 320 | 2024-03-01 |

| Barclays | Overweight | 380 | 2024-03-01 |

Investor sentiment towards Nvidia has shifted from cautiously optimistic to largely bullish over the past year, driven primarily by the company’s strong performance in the AI sector. Bullish analysts highlight Nvidia’s technological leadership and growth potential in the rapidly expanding AI market. Bearish analysts express concerns about valuation, increased competition, and potential economic slowdowns.

Illustrative Examples of Market Impact

Let’s explore hypothetical scenarios to illustrate how specific events could impact Nvidia’s stock price.

Positive Breakthrough: Imagine Nvidia unveils a revolutionary new GPU architecture specifically designed for large language models (LLMs), significantly improving training speed and efficiency. This could trigger a surge in demand, driving a sharp increase in Nvidia’s stock price, potentially exceeding 20% in a single day. The market would react positively due to the anticipated increased market share and revenue growth.

Negative Supply Chain Disruption: Suppose a major earthquake disrupts Nvidia’s key manufacturing facilities in Taiwan, causing a significant delay in production and shortages of its GPUs. This would negatively impact revenue projections, leading to a sharp decline in Nvidia’s stock price, potentially dropping by 15% or more, as investors react to the uncertainty and reduced earnings expectations.

Positive Earnings Report: A hypothetical stock chart showing a sharp price increase following a positive earnings report would exhibit a strong upward trend, potentially a “V-shaped” recovery. The chart would show a clear increase in trading volume, alongside the price surge, indicating strong investor confidence. The high volume confirms the significance of the price movement, making it a more credible and lasting impact on the stock’s valuation.

FAQ Insights

What are the major risks associated with investing in Nvidia stock?

Major risks include dependence on specific market segments (gaming, data centers), competition from other chipmakers, supply chain disruptions, and the cyclical nature of the semiconductor industry.

Where can I find real-time Nvidia stock price quotes?

Real-time quotes are available on major financial websites like Yahoo Finance, Google Finance, and Bloomberg.

How does Nvidia’s dividend policy affect its stock price?

Nvidia’s dividend policy, if any, can influence investor perception and potentially impact the stock price, though it’s typically a secondary factor compared to growth prospects.

What is the typical trading volume for Nvidia stock?

Nvidia typically experiences high trading volume due to its popularity and market capitalization; this can affect price fluctuations.