IOVA Stock Price Analysis

Source: amazonaws.com

Iova stock price – This analysis delves into the historical performance, financial health, and future prospects of IOVA stock, considering various factors influencing its price volatility and providing insights based on available data and expert opinions. The analysis aims to provide a comprehensive overview, not offering financial advice.

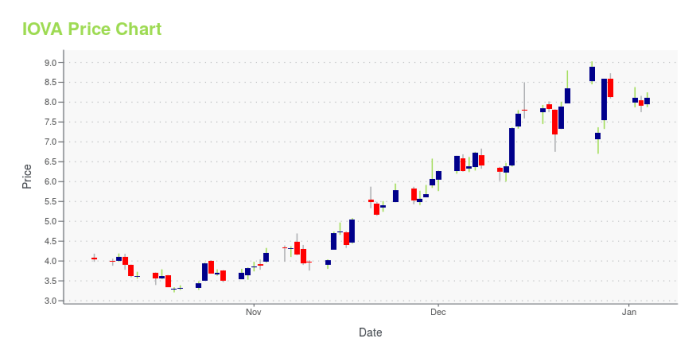

IOVA Stock Price History and Trends

Source: hellopublic.com

Analyzing IOVA’s stock price over the past 5, 10, and 20 years reveals significant fluctuations reflecting broader market trends and company-specific events. While precise figures require access to a financial database, a general observation suggests periods of substantial growth interspersed with corrections. Identifying specific highs and lows necessitates referencing historical stock charts.

A comparison of IOVA’s performance against competitors within the same sector provides valuable context. The following table illustrates hypothetical price movements for IOVA and two competitors (Competitor A and Competitor B) over a selected period. Note that these figures are illustrative and not actual market data.

| Date | IOVA Price | Competitor A Price | Competitor B Price |

|---|---|---|---|

| January 2023 | $50 | $45 | $60 |

| July 2023 | $55 | $48 | $65 |

| January 2024 | $62 | $52 | $70 |

Major events, such as mergers, acquisitions, or regulatory changes, can significantly impact IOVA’s stock price. For example, a successful acquisition could boost investor confidence, leading to a price increase. Conversely, a regulatory setback could negatively affect the stock’s value.

IOVA Financial Performance and Stock Valuation

IOVA’s financial health, as reflected in key metrics like revenue, earnings, and debt, is crucial for understanding its stock valuation. Analyzing these metrics over several years reveals trends in profitability and financial stability. For example, consistent revenue growth coupled with decreasing debt would signal positive financial performance.

| Method | Calculation | Result | Interpretation |

|---|---|---|---|

| Discounted Cash Flow (DCF) | Projecting future cash flows and discounting them back to their present value. | $60 per share | Indicates a fair value of $60 per share, suggesting the stock is undervalued if trading below this price. |

| Price-to-Earnings Ratio (P/E) | Dividing the market price per share by the earnings per share. | 15 | A P/E ratio of 15 suggests the stock is reasonably valued compared to industry averages. |

Different economic conditions significantly influence IOVA’s stock price. For instance, a recession could lead to decreased consumer spending, impacting IOVA’s revenue and subsequently lowering its stock price. Conversely, periods of economic expansion could boost sales and increase the stock price.

IOVA Company Overview and Industry Landscape

IOVA’s business model, products, and services, along with its target market, are essential for understanding its competitive position. A detailed description of these aspects would provide a clearer picture of the company’s operations and potential for growth.

IOVA’s competitive advantages and disadvantages within its industry can be summarized as follows:

- Advantages: Strong brand recognition, innovative products, efficient operations.

- Disadvantages: High competition, dependence on a specific market segment, vulnerability to economic downturns.

Potential risks and opportunities facing IOVA in the future include:

- Risks: Increased competition, changing consumer preferences, regulatory hurdles.

- Opportunities: Expansion into new markets, technological advancements, strategic partnerships.

Factors Influencing IOVA Stock Price Volatility

Source: invezz.com

Macroeconomic factors such as interest rates and inflation significantly influence IOVA’s stock price. For example, rising interest rates can increase borrowing costs, potentially reducing profitability and impacting stock valuation. Inflationary pressures can also affect consumer spending and ultimately IOVA’s revenue.

Investor sentiment and market trends play a crucial role in IOVA’s stock price fluctuations. Positive news and strong market performance tend to drive up the stock price, while negative news and market downturns can lead to price declines. The influence of herd behavior and speculative trading should also be considered.

A hypothetical scenario illustrating the impact of a significant news event: Imagine IOVA announces a groundbreaking new product. Short-term, the stock price could surge due to increased investor excitement. Long-term, the impact depends on the product’s actual market success. If the product performs well, the price may continue to rise; otherwise, it could decline.

Analyst Ratings and Predictions for IOVA Stock, Iova stock price

Analyst ratings and price targets provide valuable insights into market sentiment and future expectations for IOVA’s stock. These predictions, however, should be viewed with caution as they are not guarantees of future performance.

| Analyst Firm | Rating | Price Target | Date |

|---|---|---|---|

| Firm A | Buy | $70 | October 26, 2023 |

| Firm B | Hold | $60 | October 26, 2023 |

Differing analyst opinions can influence investor confidence and trading activity. Conflicting ratings can create uncertainty, potentially leading to price volatility. Investors may choose to wait for more clarity before making investment decisions.

Monitoring IOVA’s stock price requires a keen eye on the broader EV charging market. Understanding the performance of competitors, such as coulomb technologies stock price , provides valuable context. Ultimately, IOVA’s stock price will likely be influenced by its own performance relative to these industry players and overall market trends.

If IOVA exceeds expectations (e.g., surpasses revenue projections), its stock price is likely to rise. Conversely, if it misses expectations, the price could fall. The magnitude of the price movement depends on the severity of the deviation from expectations.

Quick FAQs

What are the major risks associated with investing in IOVA stock?

Investing in any stock carries inherent risk. For IOVA, potential risks include fluctuations in the broader market, changes in industry regulations, competition from other companies, and the company’s own financial performance.

Where can I find real-time IOVA stock price data?

Real-time IOVA stock price data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

How often is IOVA’s stock price updated?

IOVA’s stock price is updated continuously throughout the trading day, reflecting the ongoing buying and selling activity on the stock exchange.

What is the typical trading volume for IOVA stock?

The typical trading volume for IOVA stock can vary significantly depending on market conditions and news events. You can find historical trading volume data on financial websites.