Nvidia Stock Price Data Sources: Historical Stock Price For Nvidia

Source: appuals.com

Historical stock price for nvidia – Reliable historical stock price data is crucial for accurate analysis of Nvidia’s performance. Several sources provide this data, each with its own strengths and weaknesses regarding accuracy, timeliness, cost, and data format. This section will compare three prominent sources, outlining their methods for data verification and highlighting their key features and limitations.

Reliable Sources for Nvidia Stock Price Data

Three reliable sources for obtaining historical Nvidia stock prices include Yahoo Finance, Google Finance, and Refinitiv Eikon. Each offers a different balance of features, cost, and data quality.

Data Accuracy and Timeliness Comparison

Yahoo Finance and Google Finance generally provide accurate and timely data, reflecting real-time price changes with minimal delay. However, the accuracy of historical data might vary slightly depending on the time range. Refinitiv Eikon, a professional-grade platform, offers the highest level of accuracy and timeliness, but comes with a subscription fee. Data verification methods generally involve comparing data points across multiple sources to identify inconsistencies and cross-referencing with official company announcements and financial news reports.

Data Authenticity Verification Methods

Verifying the authenticity of historical stock price data involves several steps. Firstly, cross-referencing data from multiple reputable sources like those mentioned above helps identify discrepancies. Secondly, comparing the data against official company filings (like 10-Ks and 10-Qs) and press releases provides further validation. Finally, consulting financial news archives and reputable financial data providers can confirm the accuracy of major price movements.

Comparison Table of Data Sources

| Source Name | Data Accuracy | Time Range | Cost | Data Format |

|---|---|---|---|---|

| Yahoo Finance | High (minor discrepancies possible) | Extensive historical data | Free | CSV, API |

| Google Finance | High (minor discrepancies possible) | Extensive historical data | Free | CSV, API |

| Refinitiv Eikon | Very High | Extensive historical data, including intraday | Subscription Required | Various formats, including customizable exports |

Historical Price Trends and Patterns

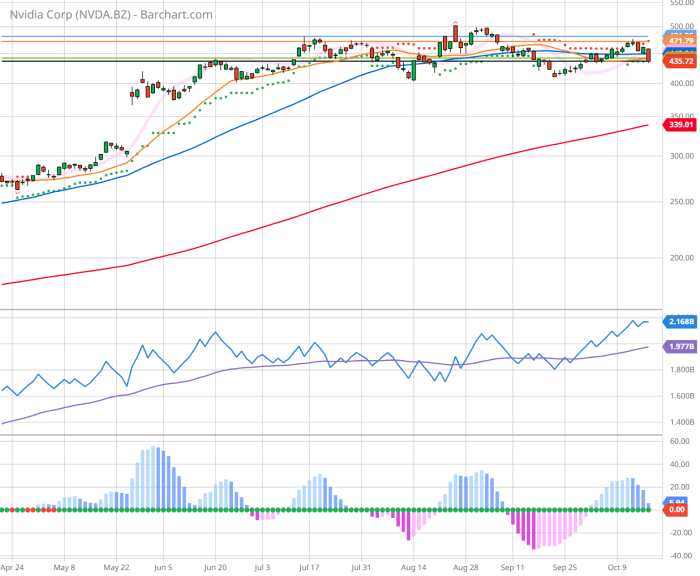

Analyzing Nvidia’s stock price over the past decade reveals periods of significant growth and volatility, driven by various factors including technological advancements, market conditions, and company performance. This section will explore these trends and their underlying causes.

Nvidia Stock Price Trend (Past 10 Years)

Over the past 10 years, Nvidia’s stock price has exhibited a predominantly upward trend, punctuated by periods of correction and consolidation. The most significant growth has been linked to the company’s success in the gaming GPU market and, more recently, its dominance in the AI and data center sectors. However, periods of decline have coincided with broader market downturns and concerns about specific product cycles or competition.

Significant Price Increase and Decrease Periods

Significant price increases have been observed during periods of strong demand for Nvidia’s GPUs, particularly during the cryptocurrency boom and the rapid adoption of AI technologies. Conversely, price decreases have often followed periods of reduced demand, economic uncertainty, or negative investor sentiment related to specific product launches or financial reports.

Analyzing historical stock price for Nvidia offers valuable insights into its growth trajectory. Understanding this performance can inform investment strategies, and it’s interesting to compare it to other tech giants. For instance, checking the current market standing, by looking at the dell stock price today , provides a contrasting perspective on the tech sector’s overall health. Returning to Nvidia, a thorough examination of its historical data reveals significant fluctuations reflecting market trends and company performance.

Impact of Major Market Events

Source: guerillastocktrading.com

Major market events, such as the 2008 financial crisis and the COVID-19 pandemic, have had a noticeable impact on Nvidia’s stock price. While the 2008 crisis led to a significant drop, the pandemic initially caused a decline but was followed by a sharp recovery fueled by increased demand for remote computing and gaming. Technological breakthroughs, such as the introduction of new GPU architectures, have also consistently driven significant price increases.

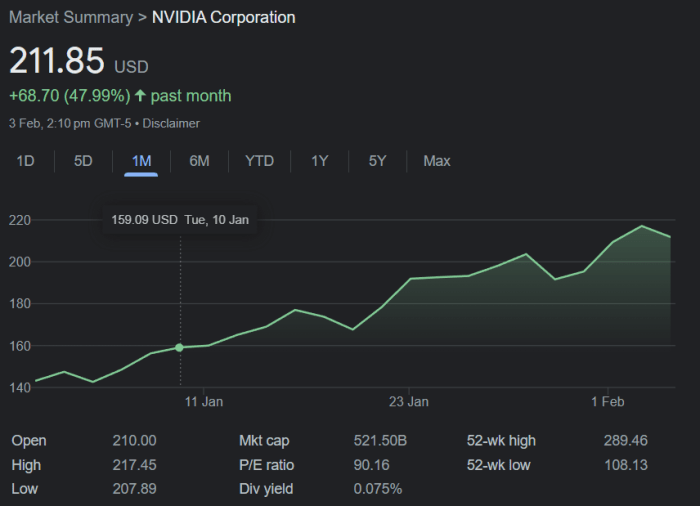

Line Graph of Historical Stock Price Movement

A line graph illustrating Nvidia’s stock price over the past 10 years would show a generally upward trend, with distinct peaks and valleys corresponding to periods of strong growth and market corrections. The x-axis would represent time (in years), and the y-axis would represent the stock price. Key milestones, such as major product launches or significant market events, would be highlighted on the graph with annotations.

The legend would simply label the Nvidia stock price line.

Factors Influencing Nvidia’s Stock Price

Several interconnected factors influence Nvidia’s stock price. These can be broadly categorized into technological advancements, financial performance, and macroeconomic conditions. Understanding these factors provides valuable insights into the company’s valuation and future prospects.

Key Factors Influencing Stock Performance

Nvidia’s stock price is heavily influenced by a complex interplay of factors. Technological advancements, particularly in GPU architecture and AI capabilities, are paramount. Strong financial performance, including revenue growth and profitability, also significantly impacts investor sentiment. Macroeconomic conditions, such as interest rates and overall market sentiment, also play a role. Furthermore, competitive pressures from companies like AMD and Intel can influence investor confidence.

Impact of Product Launches and Technological Advancements, Historical stock price for nvidia

The launch of new, high-performance GPUs and breakthroughs in AI technologies consistently drive significant positive changes in Nvidia’s stock price. These advancements often lead to increased demand from various sectors, boosting revenue and reinforcing the company’s position as a technological leader.

Role of Financial Performance

Nvidia’s financial performance, including revenue growth, profitability, and earnings per share, directly impacts its stock price. Strong financial results generally lead to positive investor sentiment and price appreciation, while weak performance can cause the opposite effect.

Categorization of Influencing Factors

- Technological Factors: New GPU architectures, AI advancements, breakthroughs in data center technologies.

- Financial Factors: Revenue growth, profitability, earnings per share, debt levels.

- Macroeconomic Factors: Interest rates, inflation, overall market sentiment, economic growth.

- Competitive Factors: Performance of competitors (AMD, Intel), market share changes.

Comparison with Competitors’ Stock Prices

Comparing Nvidia’s stock price performance to its main competitors, AMD and Intel, provides valuable context for understanding its relative strength and market positioning. This section will analyze their relative performance over the past five years and identify key factors contributing to their differing trajectories.

Relative Performance Analysis (Past Five Years)

Over the past five years, Nvidia has generally outperformed both AMD and Intel, driven largely by its success in the high-growth AI and data center markets. While AMD has shown significant growth, particularly in the CPU market, it has not matched Nvidia’s overall performance. Intel, facing increased competition, has experienced more modest growth.

Periods of Outperformance and Underperformance

Nvidia’s outperformance has been most pronounced during periods of rapid growth in the AI and data center sectors. Conversely, periods of underperformance have often coincided with broader market downturns or concerns about specific product cycles.

Comparison Table of Key Performance Indicators

| Company Name | Average Annual Return (Past 5 Years) | Volatility (Past 5 Years) | Market Capitalization (Recent) |

|---|---|---|---|

| Nvidia | [Insert Data – Requires Research] | [Insert Data – Requires Research] | [Insert Data – Requires Research] |

| AMD | [Insert Data – Requires Research] | [Insert Data – Requires Research] | [Insert Data – Requires Research] |

| Intel | [Insert Data – Requires Research] | [Insert Data – Requires Research] | [Insert Data – Requires Research] |

Impact of Specific Events on Stock Price

Certain events have significantly impacted Nvidia’s stock price. This section will examine three such events, analyzing their short-term and long-term effects and the shifts in investor sentiment that accompanied them.

Significant Events and Their Impact

Three significant events that have demonstrably influenced Nvidia’s stock price include the launch of the RTX 30 series GPUs, the acquisition of Mellanox Technologies, and the surge in demand for AI-related products. Each event resulted in both short-term and long-term impacts on the stock price, driven by changes in investor sentiment.

Event Impact Table

| Event | Date | Short-Term Impact | Long-Term Impact | Supporting Evidence |

|---|---|---|---|---|

| Launch of RTX 30 Series GPUs | [Insert Date] | [Describe Short-Term Impact – Requires Research] | [Describe Long-Term Impact – Requires Research] | [Cite News Articles or Financial Reports – Requires Research] |

| Acquisition of Mellanox Technologies | [Insert Date] | [Describe Short-Term Impact – Requires Research] | [Describe Long-Term Impact – Requires Research] | [Cite News Articles or Financial Reports – Requires Research] |

| Surge in Demand for AI Products | [Insert Date Range] | [Describe Short-Term Impact – Requires Research] | [Describe Long-Term Impact – Requires Research] | [Cite News Articles or Financial Reports – Requires Research] |

Frequently Asked Questions

What are the major risks associated with investing in Nvidia stock?

Investing in Nvidia, like any stock, carries inherent risks. These include market volatility, competition from other technology companies, dependence on specific product lines, and macroeconomic factors affecting the tech sector.

Where can I find real-time Nvidia stock price data?

Real-time data is readily available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others. Your brokerage account will also provide this information.

How does inflation affect Nvidia’s stock price?

Inflationary pressures can impact Nvidia indirectly. Increased costs for materials and manufacturing can reduce profit margins, potentially affecting investor sentiment and the stock price. Conversely, strong demand for Nvidia’s products during inflationary periods might offset these negative effects.